Question: Assume the same facts as in P811, except that the FMVs for the inventory and property, plant, and equipment of Rachel are not as precisely

Assume the same facts as in P8€“11, except that the FMVs for the inventory and property, plant, and equipment of Rachel are not as precisely specified. That is, appraisers have indicated that the FMV of the inventory is between $65,000 and $75,000 and that the FMV of the property, plant, and equipment is between $115,000 and $125,000. You, as the accountant for Rice and Associates, can use any value within these ranges to record the acquisition.

REQUIRED:

a. Assume that you wish to maximize reported income in the next period. What dollar amounts would you allocate to Rachel€™s inventory, property, plant, and equipment, and goodwill when recording the acquisition? Explain.

b. Assume that you wish to minimize reported income in the next period (e.g., when preparing the transaction for tax purposes). What dollar amounts would you allocate to Rachel€™s inventory, property, plant, and equipment, and goodwill when recording the acquisition? Explain.

Data From Problem 11

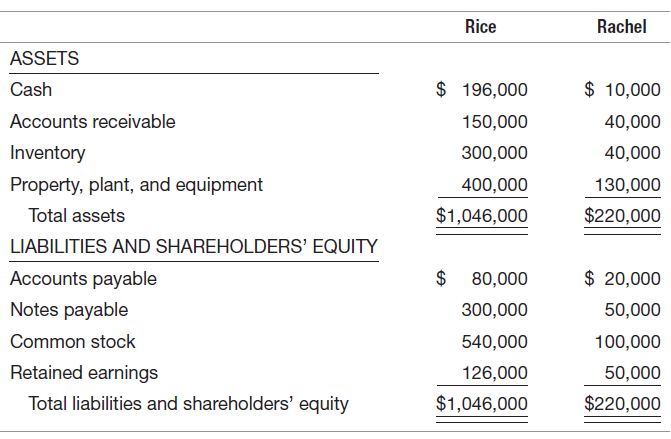

The condensed balance sheets as of December 31 for Rice and Associates and Rachel Excavation are as follows:

Rice Rachel ASSETS $ 10,000 $ 196,000 Cash Accounts receivable 40,000 150,000 40,000 Inventory 300,000 Property, plant, and equipment 130,000 400,000 Total assets $1,046,000 $220,000 LIABILITIES AND SHAREHOLDERS' EQUITY Accounts payable $ 80,000 $ 20,000 Notes payable 300,000 50,000 Common stock 540,000 100,000 Retained earnings 126,000 50,000 Total liabilities and shareholders' equity $1,046,000 $220,000

Step by Step Solution

3.41 Rating (170 Votes )

There are 3 Steps involved in it

a Net income would be affected by the values reported for inventory through cost of goods sold and fixed assets through depreciation expense Thus any ... View full answer

Get step-by-step solutions from verified subject matter experts