Question: Below are selected T-accounts for the RunnerTech Company, which reported its investments as noncurrent assets. Required: For the current year: a. Prepare the entry for

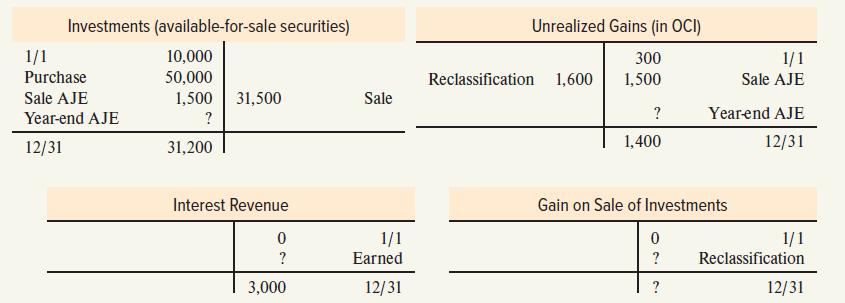

Below are selected T-accounts for the RunnerTech Company, which reported its investments as noncurrent assets.

Required:

For the current year:

a. Prepare the entry for the purchase of the available-for-sale bond securities for cash.

b. Prepare the entry for the receipt of interest on the bond investments.

c. Prepare the entry for the sale of half of the portfolio when the fair value was $31,500.

d. Prepare the entry at year-end when the remaining securities in the portfolio had a fair value of $31,200.

e. What would be reported on the balance sheet related to the available-for-sale bond investments on December 31?

f. What would be reported on the income statement for the year?

g. How would year-end reporting change if the investments were categorized as trading securities instead of available-for-sale securities?

Investments (available-for-sale securities) 10,000 50,000 1/1 Purchase Sale AJE Year-end AJE 12/31 1,500 31,500 ? 31,200 Interest Revenue 0 ? Sale 1/1 Earned 12/31 Unrealized Gains (in OCI) 300 1,600 1,500 Reclassification ? 1,400 Gain on Sale of Investments 0 ? ? 1/1 Sale AJE Year-end AJE 12/31 1/1 Reclassification 12/31

Step by Step Solution

3.39 Rating (158 Votes )

There are 3 Steps involved in it

e Balance Sheet Assets noncurrent Investments 31200 f Income Statement Other Items Gain on sale of i... View full answer

Get step-by-step solutions from verified subject matter experts