Question: Below are selected T-accounts for the RunnerTech Company, which reported its investments as noncu... Below are selected T-accounts for the RunnerTech Company, which reported its

Below are selected T-accounts for the RunnerTech Company, which reported its investments as noncu...

Below are selected T-accounts for the RunnerTech Company, which reported its investments as noncu...

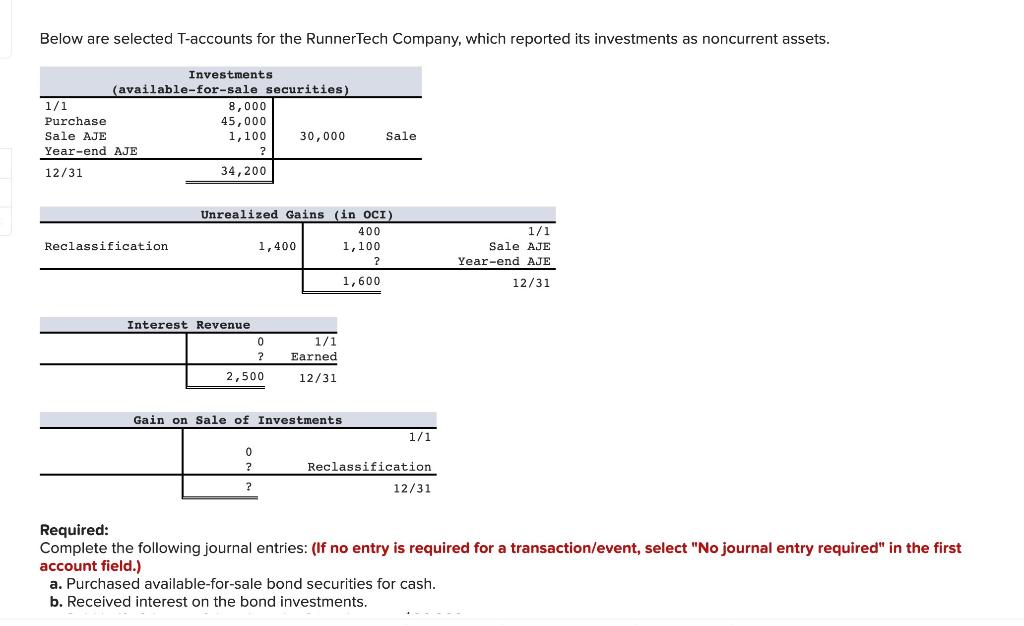

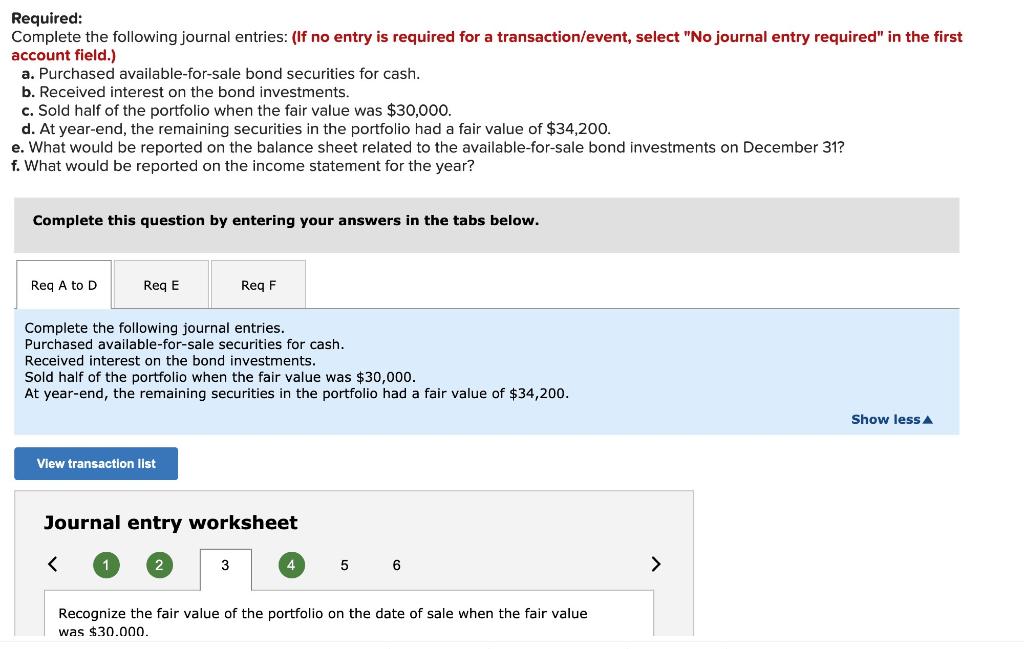

Below are selected T-accounts for the RunnerTech Company, which reported its investments as noncurrent assets. Investments (available-for-sale securities) 1/1 8,000 Purchase 45,000 Sale AJE 1,100 30,000 Year-end AJE 2 12/31 34,200 Sale Reclassification Unrealized Gains (in OCI) 400 1,400 1,100 ? 1,600 1/1 Sale AJE Year-end AJE 12/31 Interest Revenue 0 ? 2,500 1/1 Earned 12/31 Gain on Sale of Investments 1/1 ? ? Reclassification 12/31 Required: Complete the following journal entries: (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) a. Purchased available-for-sale bond securities for cash. b. Received interest on the bond investments. Required: Complete the following journal entries: (If no entry is required for a transaction/event, select "No journal entry required in the first account field.) a. Purchased available-for-sale bond securities for cash. b. Received interest on the bond investments. c. Sold half of the portfolio when the fair value was $30,000. d. At year-end, the remaining securities in the portfolio had a fair value of $34,200. e. What would be reported on the balance sheet related to the available-for-sale bond investments on December 31? f. What would be reported on the income statement for the year? Complete this question by entering your answers in the tabs below. Reg A to D Reg E ReqF Complete the following journal entries. Purchased available-for-sale securities for cash. Received interest on the bond investments. Sold half of the portfolio when the fair value was $30,000. At year-end, the remaining securities in the portfolio had a fair value of $34,200. Show less A View transaction list Journal entry worksheet Recognize the fair value of the portfolio on the date of sale when the fair value was $30.000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts