Deepak Fertilizers and Petrochemicals Corporation Limited (DFPCL) is part of the CK Mehta business group. It is

Question:

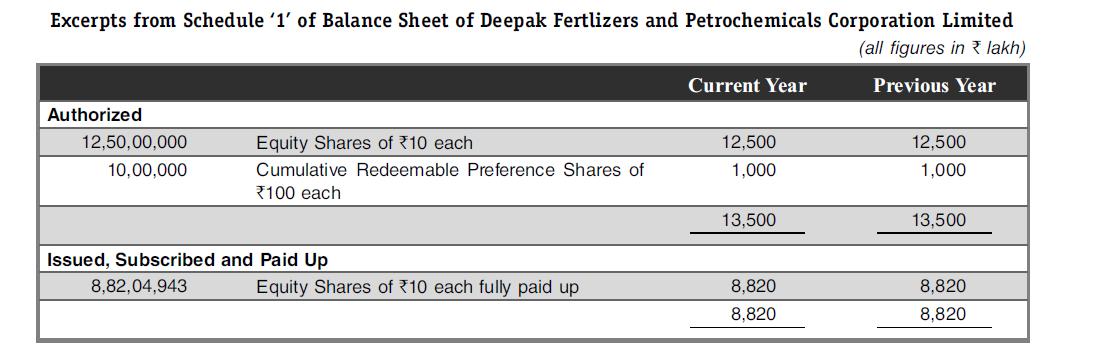

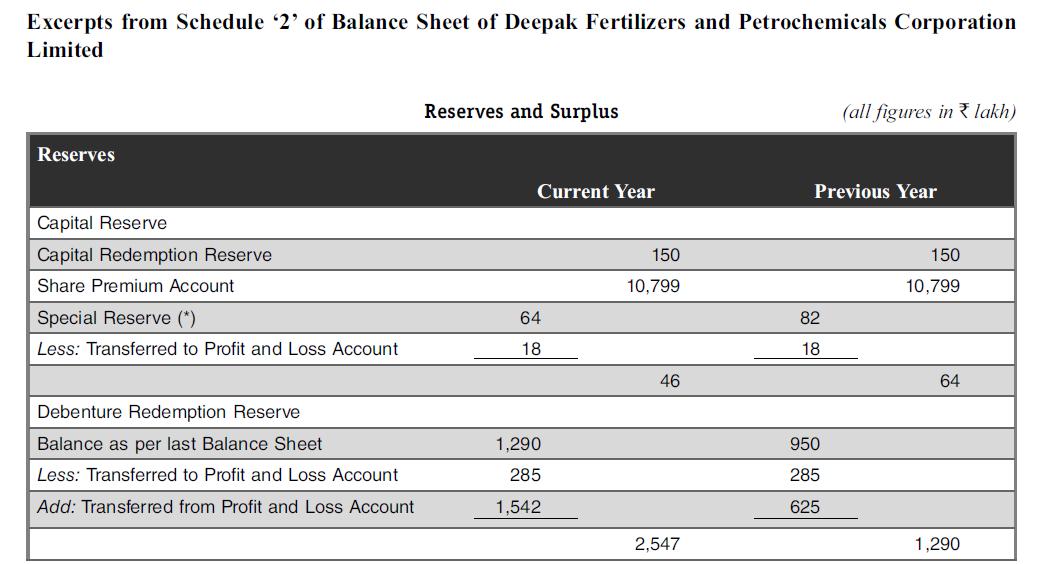

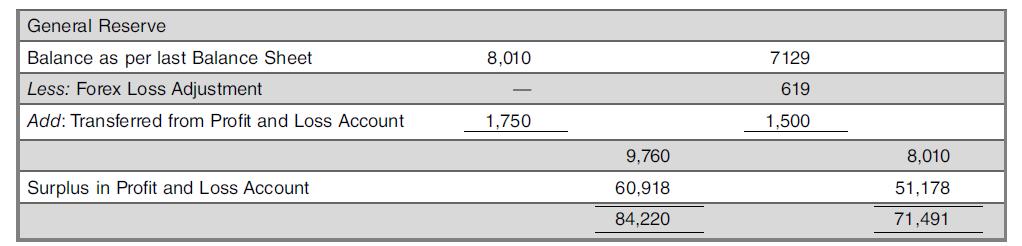

Deepak Fertilizers and Petrochemicals Corporation Limited (DFPCL) is part of the CK Mehta business group. It is a multi-product portfolio company consisting of chemicals, petrochemicals, fertilizers and other agri-inputs. We present here the excerpts (Schedules 1 to 3) forming part of the balance sheet of DFPCL’s annual report for the financial year ending 2010.

Notes:

A. Long-Term Loans

1. 500 Secured Redeemable Non-Convertible Debentures of the face value of ₹10 lakh each on Private Placement basis aggregating ₹5,000 lakh carrying coupon rate of 9.75% per annum payable quarterly and redeemable in three equal instalments from 25th November, 2013 to 25th November, 2015.

2. 500 Secured Redeemable Non-Convertible Debentures of the face value of ₹10 lakh each on Private Placement basis aggregating ₹5,000 lakh carrying coupon rate of 10% per annum payable quarterly, and redeemable in three equal instalments from 25th November, 2013 to 25th November, 2015.

3. The Rupee Term Loan of ₹9,100 lakh made available from 10th September, 2009, is repayable in 28 quarterly installments of ₹325 lakh each commencing from 10th September, 2011, and the last instalment is payable on 10th June, 2018.

4. The Rupee Term Loan of ₹3,500 lakh made available from 8th September, 2009, is repayable in 28 quarterly instalments of ₹125 lakh each commencing from 8th September, 2011, and the last instalment is payable on 8th June, 2018.

5. The ECB loan of US $20 million is repayable in 27 quarterly instalments of US $7.15 lakh each commencing from the first date of disbursement and balance of US $6.95 lakh shall be payable as last instalment. The loan is yet to be availed.

6. The ECB loan of US $25 million made available from 18th February, 2010, is repayable in 6 equal half-yearly instalments from 31st January, 2014, and last installment is payable on 29th July, 2016.

The above debentures and loans are secured by pari passu first charge on the entire fixed assets pertaining to Technical Ammonium Nitrate (TAN Project), the leasehold rights and interest in Plot Nos. K-7 & K-8 at MIDC Industrial area, Taloja, Dist. Raigad and the building(s)/structure(s) standing or to be constructed thereon and all fixed plants and machineries installed/to be installed thereon and all movable machineries, equipment and other movable assets of the said project, both present and future, and the equipment, furniture, fixtures and fittings (excluding current assets) along with payment of interest and additional interest on the said loans, debentures, costs, charges, expenses and remuneration of the trustees and all other monies thereto.

7. 500 Secured Redeemable Non-Convertible Debentures of the face value of ₹10 lakh each on Private Placement basis aggregating ₹5,000 lakh carrying coupon rate of 8.35% per annum payable quarterly and redeemable in single installment on 9th February, 2013.

The above Debentures are secured by a pari passu first charge on the entire fixed assets pertaining to Ishanya Mall of the Company off Airport Road, Shastri Nagar, Yerawada, Pune, along with interest, additional interest, costs, charges, expenses and remuneration of the Trustees and all other monies thereto.

B. Short-term Borrowings

Credit facility of ₹5,500 lakh repayable within 180 days in one single payment together with interest, costs, charges and expenses is secured by way of deposit and pledge of Fertilizers Subsidy Bonds issued by Government of India, together with the required related transfer documents as applicable in respect thereof duly signed/executed as collateral security for the repayment on demand. The Company has option to avail this facility.

C. Cash Credit Facilities

Cash credit facilities from banks including Working Capital Demand Loan are secured by :

(a) a first charge by way of hypothecation of stocks of raw materials, finished goods, stock-in-process, consumable stores and book debts of the Company; and

(b) mortgage by deposit of title deeds, such mortgage to always rank subject to, subservient and subordinate to the mortgages, charges and securities that have been already created or may be created hereinafter by the Company in favor of public financial institutions, banks, credit agencies incorporated or constituted in India or abroad or machinery suppliers and/or other persons providing finance for purchase of assets or for purchase of specific items of machinery and equipment under any deferred payment schedule or bills rediscounting scheme.

Case Questions

(a) Are the debentures secured? What are the covenants mentioned in the issue of these debentures?

(b) What are the covenants attached to short term borrowings?

(c) What were the main changes in the above schedule during the year 2010?

(d) Were there any issues of equity shares, preference shares, or debentures during the financial year 2010 by DFPCL? If so, please prepare entries assuming exact subscription, for the above changes in the balance sheet items?

(e) Why is the Special Reserve decreasing whereas all other reserves are either constant or increasing?

Step by Step Answer:

Financial Accounting For Management

ISBN: 9789385965661

4th Edition

Authors: Neelakantan Ramachandran, Ram Kumar Kakani