During the year ended 30 June 2019, the following information was recorded in the companys accounts: 1.

Question:

During the year ended 30 June 2019, the following information was recorded in the company’s accounts:

1. Credit sales, $200 000.

2. Cash sales, $6000.

3. Collections from customers, $150 000.

4. Purchases of inventory on credit, $70 000.

5. Payments of accounts payable, $50 000.

6. Cost of goods sold, $80 000.

7. Wages expense, $90 000, not yet paid.

8. Wages paid, $22 000.

9. Paid tax payable, $6000.

10. Cash dividends of $20 000, declared and paid.

Required:

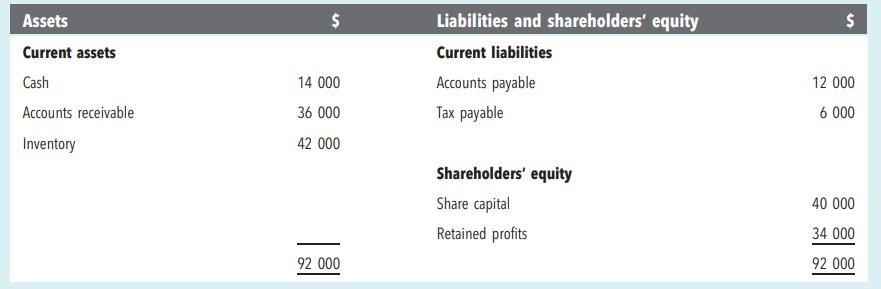

Prepare journal entries, an income statement for the year ended 30 June 2019 and a balance sheet as at 30 June 2019.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Financial Accounting An Integrated Approach

ISBN: 9780170411028

7th Edition

Authors: Ken Trotman, Elizabeth Carson

Question Posted: