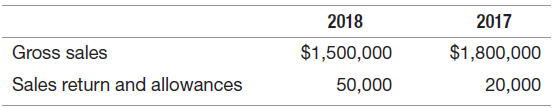

Glacier Ice Company uses a percentage-of-net-sales method to account for estimated bad debts. Historically, 3 percent of

Question:

REQUIRED:

a. Prepare the necessary adjusting entry on December 31, 2017, to record the estimated bad debt expense for 2017.

b. Assume that the January 1, 2017, balance in allowance for doubtful accounts was $65,000 (credit) and that $70,000 in bad debts was written off the books during 2017. What is the December 31, 2017, balance in this account after adjustments?

c. Prepare the necessary adjusting entry on December 31, 2018, to record the estimated bad debt expense for 2018.

d. What is the December 31, 2018, balance in allowance for doubtful accounts? Assume that $85,000 in bad debts was written off the books during 2018.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: