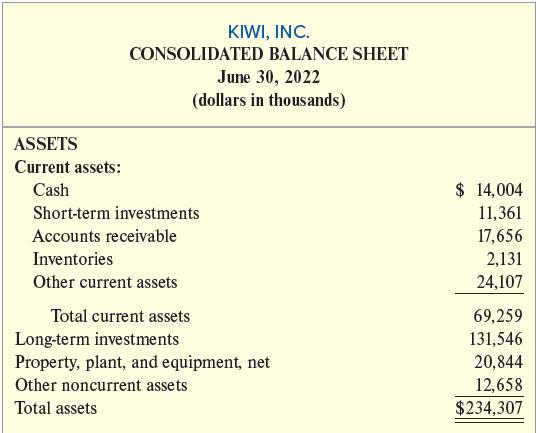

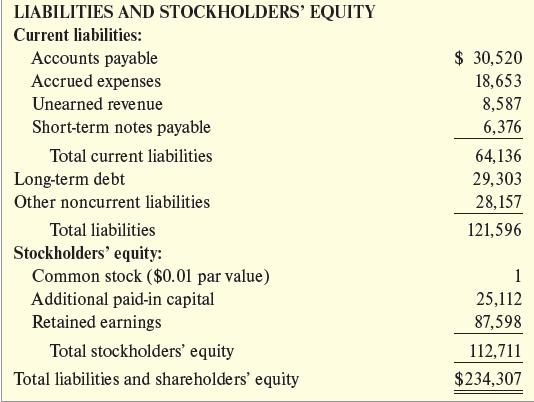

Kiwi, Inc., headquartered in Boston, Massachusetts, designs, manufactures, and markets headphones and other audio components. The following

Question:

Kiwi, Inc., headquartered in Boston, Massachusetts, designs, manufactures, and markets headphones and other audio components. The following is Kiwi’s (simplified) balance sheet from a recent fiscal year ending on June 30.

Assume that the following transactions (in thousands) occurred during the next fiscal year (ending on June 30, 2023):

a. Borrowed $18,296 from banks due in two years.

b. Purchased additional investments for $23,800 cash; one-fifth were long term and the rest were short term.

c. Purchased property, plant, and equipment; paid $9,603 in cash and signed a short-term note for $1,440.

d. Issued additional shares of common stock for $1,500 in cash; total par value was $1 and the rest was in excess of par value.

e. Sold short-term investments costing $19,038 for $19,038 cash.

f. Declared $11,156 in dividends to be paid at the beginning of the next fiscal year.

Required:

1. Prepare a journal entry for each transaction. Use the account titles on the Kiwi balance sheet and show answers in thousands of dollars.

2. Create T-accounts for each balance sheet account and include the June 30, 2022, balances; create a new account, Dividends Payable, with a $0 beginning balance. Post each journal entry to the appropriate T-accounts.

3. Prepare a trial balance at June 30, 2023.

4. Prepare a classified balance sheet for Kiwi at June 30, 2023, based on these transactions.

5. Compute Kiwi’s current ratio on June 30, 2023. (Round your answer to two decimal places.) What does this suggest about the company?

Step by Step Answer:

Financial Accounting

ISBN: 9781264229734

11th Edition

Authors: Robert Libby, Patricia Libby, Frank Hodge