Morning star, a firm that evaluates and rates mutual fund performance, published an article on its website

Question:

REQUIRED:

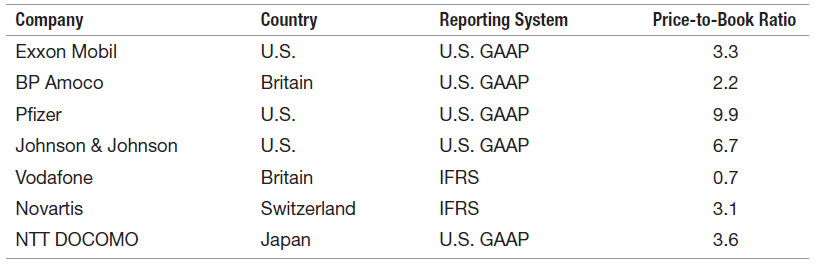

Discuss why book value and market value are not the same. What factors would increase or decrease the price-to-book ratio? How could the nature of the business or the health of the economy affect the ratio?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: