Pappu & Gappu Textiles began operations in 2010. At the beginning of the year the company purchased

Question:

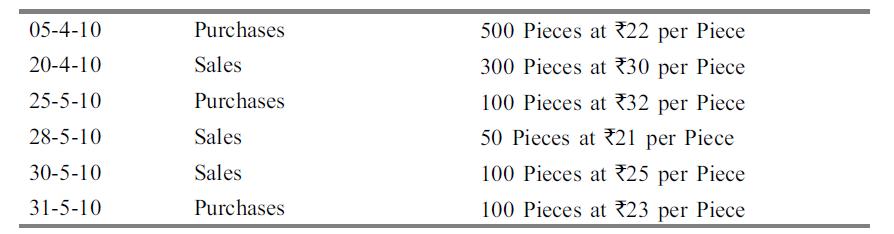

Pappu & Gappu Textiles began operations in 2010. At the beginning of the year the company purchased a machinery of ₹1,00,000, with an estimated useful life of 10 years and no residual value. During the year, the company had made an expense of ₹20,000 and ₹80,00 as salary and other expenses, respectively. The purchase and sales of inventory are as follows:

The management has the choice of accounting methods, but they are unsure how those methods will affect the net income. They have heard of the FIFO and LIFO inventory methods and straight line and written down value depreciation methods.

You are required to prepare two income statements for Pappu & Gappu Textiles one usng FIFO and straight line methods and the other using the LIFO and written down value methods. Ignore taxes.

Step by Step Answer:

Financial Accounting For Management

ISBN: 9789385965661

4th Edition

Authors: Neelakantan Ramachandran, Ram Kumar Kakani