Question: Pendleton Enterprises began operations on January 1, 2016. Balance sheet and income statement information for 2016, 2017, and 2018 follow: REQUIRED: a. Prepare the operating

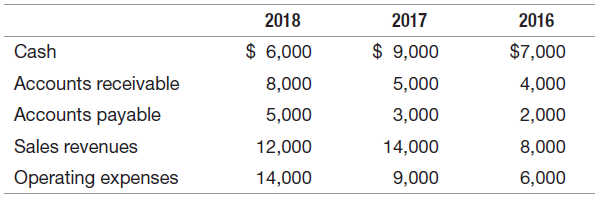

Pendleton Enterprises began operations on January 1, 2016. Balance sheet and income statement information for 2016, 2017, and 2018 follow:

REQUIRED:

a. Prepare the operating sections of the statement of cash flows for 2016, 2017, and 2018 under the direct method.

b. Assume that the $4,000 of outstanding accounts receivable on December 31, 2016, was actually collected before the end of 2016 but that the accounts receivable balances for 2017 and 2018 are unchanged. Prepare the statements of cash flows under the direct method for all three years.

c. Ignore the assumption in (b), and assume alternatively that the company deferred an additional $3,000 on the payment of accounts payable as of December 31, 2016 (i.e., accounts payable equal $5,000, and cash equals $10,000 on December 31, 2016). The accounts receivable balances for 2017 and 2018 are unchanged. Prepare the operating section of the statements of cash flows for all three periods.

d. How can managers manipulate cash provided (used) by operations, and what usually happens in the subsequent period?

2018 2017 2016 $ 6,000 $ 9,000 $7,000 Cash Accounts receivable 5,000 8,000 4,000 Accounts payable Sales revenues 5,000 3,000 2,000 12,000 14,000 8,000 Operating expenses 14,000 9,000 6,000

Step by Step Solution

3.39 Rating (152 Votes )

There are 3 Steps involved in it

a Pendleton Enterprises Statement of Cash Flows from Operating Activities For the Years Ended December 31 2016 2017 and 2018 2018 2017 2016 Cash colle... View full answer

Get step-by-step solutions from verified subject matter experts