Ramson Limited and Macson Limited are strong competitors running the business in the pharmaceutical industry for about

Question:

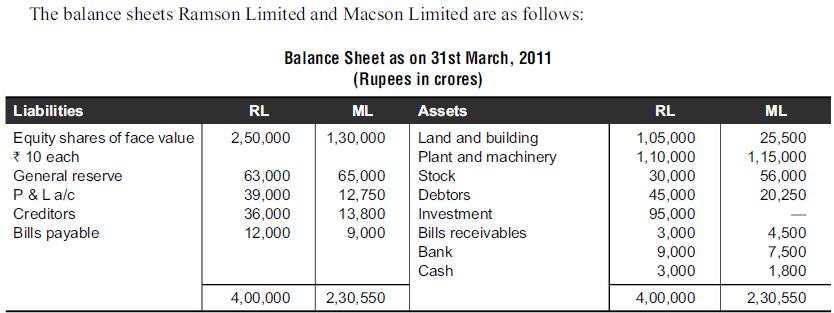

Ramson Limited and Macson Limited are strong competitors running the business in the pharmaceutical industry for about last 20 years. Both of the companies realized that due to competition they were spending heavy money on sales promotion and doctors made an advantage out of it. On 31st January, 2011, managing directors of both the companies negotiated the scheme of business combination. The scheme was subsequently approved by the shareholders and by the regulator. The abstracts from the amalgamation scheme are given below.

On the balance sheet date, RML acquired the business of both and ML. RML agreed to discharge the purchase consideration by issuing requisite number of its equity shares at and issue price of ₹18 against the face value of ₹10 per share. Further it agreed to value the land and building at a 10% higher value for both the companies, it also agreed to value plant and machinery at an appreciation of 20% on the existing book value, but valued the investment at ₹78,000 only. The debtors of RL comprise ₹15,000 crore due from ML, bills receivables of ML comprise of bills accepted by RL of ₹1,000 crore.

Discussion Question

1. How will you recognize purchase consideration and different assets and liabilities in the books of HL?

2. Calculate purchase consideration for both the companies.

3. Identify the acquirer using IFRS 03 or Ind-AS-103 rules.

4. Prepare post amalgamation balance sheet of RML.

5. Had both the companies agreed to maintain their pre-amalgamation book value per share, then what should have been the purchase consideration for each of the companies?

Step by Step Answer: