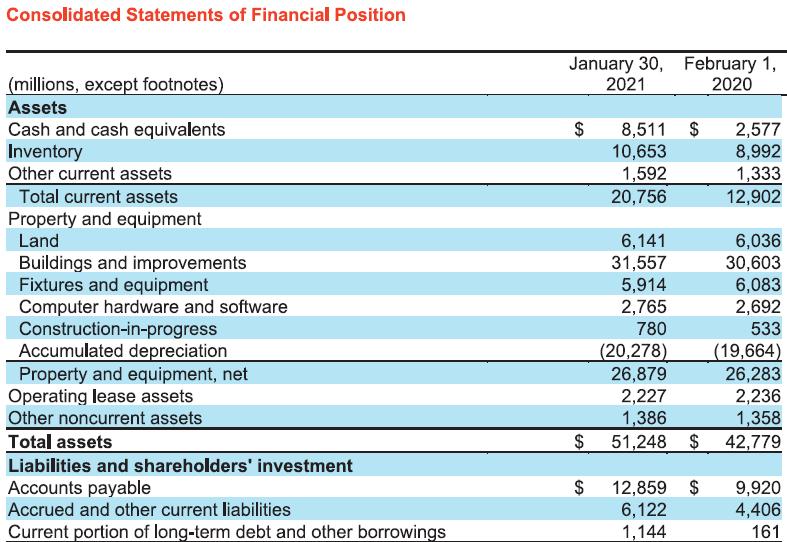

Refer to the financial statements of Target Corporation in Appendix B at the end of this book.

Question:

Refer to the financial statements of Target Corporation in Appendix B at the end of this book. All dollar amounts are in millions.

Data From in Appendix B

1. Did the company accrue more or pay more for wages and benefits in the most recent fiscal year and by how much?

a. Target accrued more by $519.

b. Target accrued more by $1,677.

c. Target paid more by $1,158.

d. Target paid more by $1,716.

e. Cannot determine the effect or amount by the information provided.

2. Did the company receive more or accrue more for accounts and other receivables in the most recent fiscal year and by how much?

a. Target received more by $133.

b. Target accrued more by $259.

c. Target accrued more by $133.

d. Target received more by $259.

e. Cannot determine the effect or amount by the information provided.

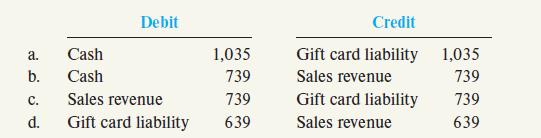

3. Of the $935 balance in gift card liability on February 1, 2020, what adjusting entry did Target make to recognize revenue during the most recent year for gift cards redeemed by customers?

4. What is(are) Target’s revenue recognition policy(ies) for merchandise sales?

a. Target records Target gift card sales upon redemption, which is typically within one year of issuance.

b. Target records almost all retail store revenues at the point of sale.

c. Target records digital sales upon delivery to the customer.

d. All of the above are revenue recognition policies for Target.

5. Which of the following is included in the closing entry for Target for the most recent year?

a. Debit to Cost of Sales, $66,177

b. Credit to Selling, General and Administrative expenses, $18,615

c. Debit to Accumulated Depreciation, $20,278

d. Credit to Sales Revenue, $92,400

e. Debit to Retained Earnings, $4,368

6. What is the total asset turnover ratio for the most recent fiscal year and what does this suggest about the company?

a. 1.99, suggesting that Target’s management generates $1.99 in operating revenues for every dollar of assets.

b. 0.51, suggesting that Target generates $0.51 for every dollar of sales revenue.

c. 0.09, suggesting that Target’s management is not effective at utilizing assets to generate earnings.

d. 2.47, suggesting that Target’s management is effective at balancing the ratio of current assets to total assets.

Step by Step Answer:

Financial Accounting

ISBN: 9781264229734

11th Edition

Authors: Robert Libby, Patricia Libby, Frank Hodge