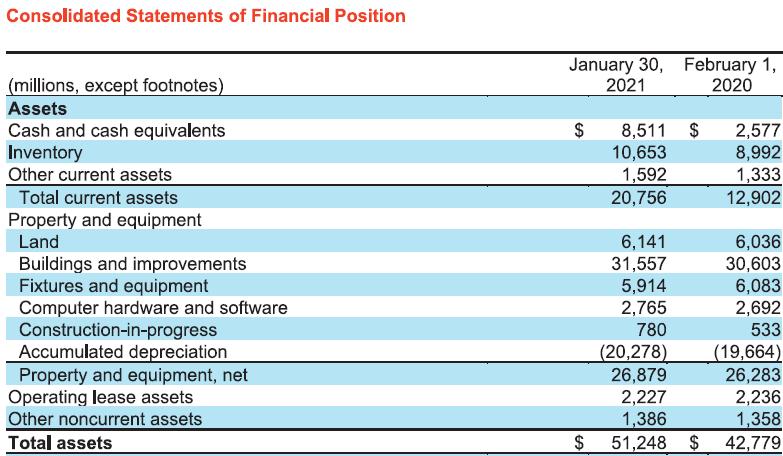

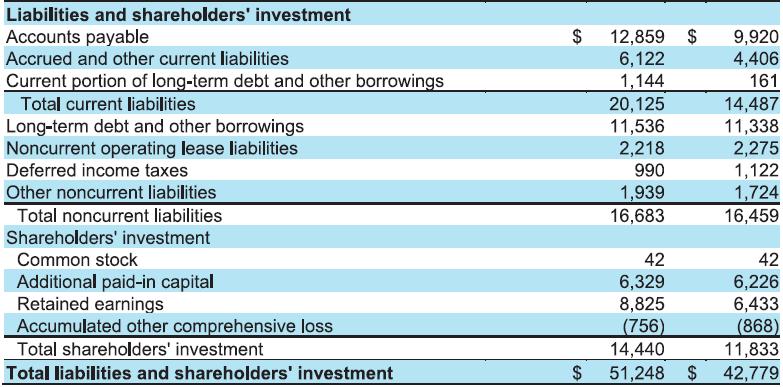

Refer to the financial statements of Target Corporation in Appendix B at the end of this book.

Question:

Refer to the financial statements of Target Corporation in Appendix B at the end of this book. All dollar amounts are in millions. Use the notes to the financial statements for answering some of the questions.

Data from in Appendix B

1. How much did the company spend on property and equipment (capital expenditures) in the most recent fiscal year and where did you find this information?

1. How much did the company spend on property and equipment (capital expenditures) in the most recent fiscal year and where did you find this information?

a. $26,879, found on the balance sheet.

b. $26,283, found on the balance sheet.

c. $2,649, found on the statement of cash flows.

d. $3,516, found on the statement of cash flows.

e. $1,210, determined from information on the balance sheet.

2. What is the percentage of Target’s cost of computer hardware and software to its total cost of property and equipment for the most recent year? Round to the one decimal place.

a. 5.9 percent

b. 10.3 percent

c. 5.4 percent

d. 39.6 percent

e. Cannot determine the percentage from the information provided.

3. Using information (1) on the cash received from disposal of property and equipment, (2) that all noncash losses for the most recent year related to the disposal of property and equipment, and (3) that the accumulated depreciation on the property and equipment that was sold was $1,311, what was the original cost of the property and equipment that was sold during the most recent year? (Hints: Review the statement of cash flows and reconstruct the journal entry made to dispose of the property and equipment.)

a. $1,439

b. $1,353

c. $1,397

d. Some other amount.

4. What method does Target use to depreciate its property and equipment?

a. Units-of-production

b. Declining-balance

c. Straight-line

d. MACRS

5. What was the amount of Goodwill reported for the most recent year?

a. $668

b. $663

c. $37

d. $631

e. Goodwill is not disclosed in the Target 10-K report.

6. How much did Target recognize as impairment losses in fiscal year ending February 1, 2020?

a. $92

b. $23

c. $62

d. $0

7. What was Target’s fixed asset turnover ratio for the most recent year presented and what does is suggest about Target?

a. 3.48, suggesting that Target’s management is efficient in utilizing fixed assets to generate sales.

b. 3.52, suggesting that Target’s management is efficient in utilizing fixed assets to generate total operating revenues.

c. 1.97, suggesting that Target’s management is not efficient in utilizing fixed assets to generate sales.

d. 0.16, suggesting that Target’s management is not efficient in utilizing assets to generate net income.

Step by Step Answer:

Financial Accounting

ISBN: 9781264229734

11th Edition

Authors: Robert Libby, Patricia Libby, Frank Hodge