Refer to the financial statements of Target given in Appendix B at the end of this book.

Question:

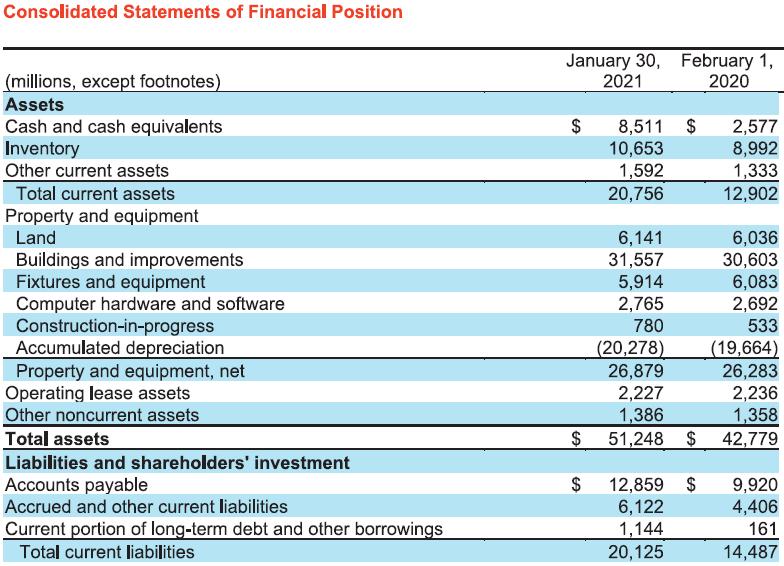

Refer to the financial statements of Target given in Appendix B at the end of this book. At the bottom of each statement, the company warns readers to “Refer to Notes to Consolidated Financial Statements.” The following questions illustrate the types of information that you can find in the financial statements and accompanying notes.

Data from in Appendix B

Required:

1. What items were included as Noncurrent assets on the balance sheet? (Select all that apply.)

a. Property and equipment

b. Operating lease assets

c. Inventory

d. Other noncurrent assets

e. Deferred income taxes

2. How much land did the company own at the end of the most recent reporting year?

a. $26,879

b. $5,914

c. $6,141

d. $6,036

e. None of the above

3. What percentage of Accrued and other current liabilities was “Gift card liability” at the end of the current year (round to one decimal place)?

a. 16.9%

b. 11.3%

c. 4.7%

d. 28.2%

e. None of the above

4. At what point were digitally originated (website) sales recognized as revenue?

a. When the order is placed

b. When the order is shipped

c. When the order is paid for

d. Upon delivery or pickup

e. None of the above

5. The company reported cash flows from operating activities of $10,525. However, its net income was only $4,369 for the current year. What was the largest single cause of the difference?

a. Depreciation and amortization

b. Increase in Accounts payable

c. Increase in Inventory

d. Expenditures for property and equipment

e. Deferred income taxes

6. Calculate the company’s ROA for the year ended January 30, 2021. Round your percentage answer to two decimal places.

a. 9.29%

b. 5.61%

c. 8.52%

d. 29.33%

e. None of the above

Step by Step Answer:

Financial Accounting

ISBN: 9781264229734

11th Edition

Authors: Robert Libby, Patricia Libby, Frank Hodge