Set up in 1986, Ambuja Cements Limited (Ambuja) had aggressively pursued growth to increase its size ten-fold

Question:

Set up in 1986, Ambuja Cements Limited (Ambuja) had aggressively pursued growth to increase its size ten-fold in one decade. The total cement capacity of the company is 18.5 million tonnes. Its plants became the most efficient in the world with environment protection measures that were on par with the finest in the developed world.

The company’s most distinctive attribute, however, was its approach to the business. Ambuja followed a unique homegrown philosophy of giving people the authority to set their own targets, and the freedom to achieve their goals. This simple vision created an environment where there were no limits to excellence, no limits to efficiency and had proved to be a powerful engine for Ambuja. As a result, Ambuja became the most profitable cement company in India, and one of the lowest cost cement producers in the world.

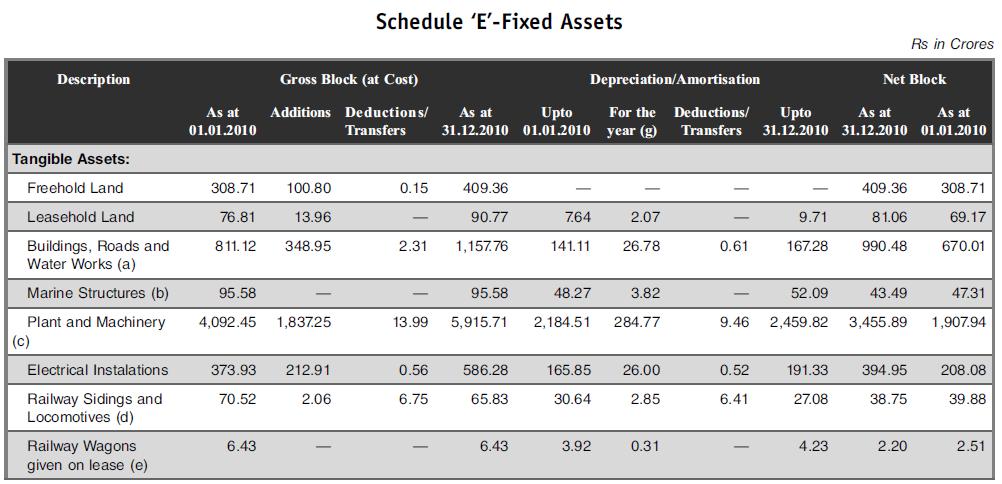

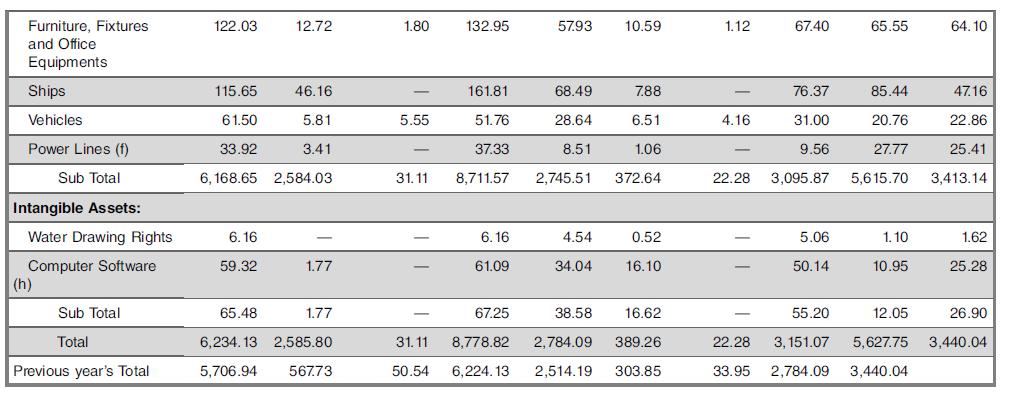

Following are excerpts from their annual report of December 2010. These relate to a change in the depreciation policy and practices adopted by the company:

Notes:

(a) Includes:

(i) Premises on ownership basis of ₹95.75 crore (31.12.2009–₹95.30 crore) and ₹7.31 crores (31.12.2009–₹6.15 crore) being the depreciation thereon upto 31st December, 2010. Cost of shares in Co-operative Societies ₹13,130 (31.12.2009–₹13,130).

(ii) ₹13.91 crores (31.12.2009 - ₹10.47 crore) being cost of roads constructed by the company, ownership of which vests with the Governement/Local Authorities and ₹1.05 crore (31.12.2009 – ₹0.94 crore) being the depreciation thereon up to 31st December, 2010.

(b) Cost incurred by the Company, ownership of which vests with the State Maritime Boards.

(c) Includes ₹34.02 crore (31.12.2009 – ₹22.43 crore) being cost of bulkers and tippers used as Material Handling Equipment, which are being depreciated under the “Written Down Value Method” at the rate applicable to vehicles and ₹18.54 crores (31.12.2009 – ₹16.59 crore) being the depreciation thereon up to 31st December, 2010.

(d) Includes ₹6.84 crore (31.12.2009 – ₹6.84 crore) being cost of Railway siding constructed by the Company, ownership of which vests with the Government/Railway Authorities and ₹1.03 crores (31.12.2009 – ₹0.71 crore) being the depreciation thereon up to 31st December, 2010.

(e) Railway wagons given on lease to the Railway under “Own Your Wagon Scheme”.

(f) Cost incurred by the Company, ownership of which vests with the State Electricity Boards.

(g) Includes ₹2.06 crore (31.12.2009 – ₹6.86 crore) capitalized as pre-operative expenses.

(h) Computer software is amortized over a period of three years. The remaining amortization period ranges from six months to three years.

The notes to accounts of the company included the following lines:

Depreciation and Amortization:

I. Tangible Assets:

(i) Premium on leasehold land is amortised over the period of lease.

(ii) Depreciation on all assets, other than Vehicles, is provided on the “Straight Line Method” in accordance with the provisions of Section 205(2)(b) of the Companies Act, 1956, and on Vehicles on the “Written Down Value Method” in accordance with the provisions of Section 205(2)(a) of the Companies Act, 1956, in the manner and at the rates specified in Schedule XIV to the Companies Act, 1956, as the management estimate of useful life coincides with useful life based on the rate mentioned in the Schedule XIV or is higher. Continuous process plants, are identified based on technical assessment and depreciated at the specified rate as per Schedule XIV to the Companies Act, 1956. Depreciation on additions to fixed assets is provided on a pro-rata basis from the date of acquisition or installation, and in the case of a new project, from the date of commencement of commercial production. Depreciation on assets sold, discarded, demolished or scrapped, is provided upto the date on which the said asset is sold, discarded, demolished or scrapped.

In respect of an asset for which impairment loss is recognised, depreciation is provided on the revised carrying amount of the assets over its remaining useful life.

(iii) Machinery spares which are capitalised are depreciated over the useful life of the related fixed asset. The written down value of such spares is charged to the Profit and Loss Account, on issue for consumption.

(iv) The cost of fixed assets, constructed by the Company, but ownership of which belongs to Government/ Local Authorities, is amortised at the rate of depreciation specified in Schedule XIV to the Companies Act, 1956.

(v) Expenditure on Power Lines, ownership of which belongs to the State Electricity Boards, is amortised over the period as permitted in the Electricity Supply Act, 1948.

(vi) Expenditure on Marine Structures, ownership of which belongs to the Maritime Boards, is amortised over the period of agreement.

II. Intangible Assets:

(i) Expenditure to acquire Water Drawing Rights from Government/Local Authorities/other parties, is amortised on straight line method over the period of rights to use the facilities ranging from ten to thirty years.

(ii) Expenditure on computer software is amortized on straight line method over the period of expected benefit not exceeding five years.

Leases:

Where the Company is the lessee

Leases where the lessor effectively retains substantially all the risks and benefits of ownership of the leased item, are classified as operating leases. Operating lease payments are recognized as an expense in the Profit and Loss account on a straight-line basis over the lease term.

Where the Company is the lessor

(i) Assets given under finance lease are recognised as a receivable at an amount equal to the net investment in the lease. Lease rentals are apportioned between principal and interest on the internal rate of return (IRR) method. The principal amount received reduces the net investment in the lease and interest is recognised as revenue. Initial direct cost such as legal costs, brokerage costs, etc. are recognized immediately in the Profit and Loss Account.

(ii) Assets subject to operating leases are included in fixed assets. Lease income is recongnised in the Profit and Loss Account on a straight-line basis over the lease term. Costs, including depreciation are recognised as an expense in the Profit and Loss Account. Initial direct costs such as legal costs, brokerage costs, etc. are recognized immediately in the Profit and Loss Account.

Case Questions

(a) Please list out the possible journal entries the company may have had to make to note the above changes.

(b) During the stated financial year, what type of fixed assets is the company churning? and what type of fixed assets is the company not churning? Discuss.

(c) You are required to link the above notes with the company’s fixed assets schedule and comment on the same.

(d) Did the company provide enough information to the readers of annual reports? Discuss.

Step by Step Answer:

Financial Accounting For Management

ISBN: 9789385965661

4th Edition

Authors: Neelakantan Ramachandran, Ram Kumar Kakani