The following adjustments need to be made in the accounts of Ricksu at the year-end 31.03.03. (a)

Question:

(a) Bad debts of £3,000 are to be written off against total trade receivables balance of £27,000. The provision for bad debts is to stand at 5% of trade receivables after bad debts have been written off. The provision currently stands in the books at £1,300.

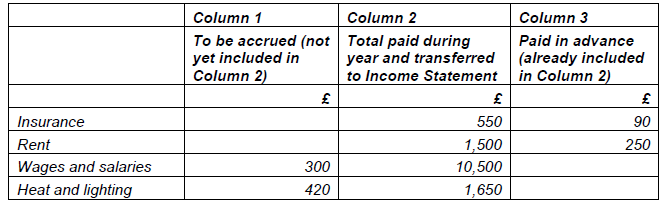

(b) The following information relates to expenses:

(c) During the year, vehicles with a NBV of £6,000, cost £14,000 were sold for £5,800. This sale had not been accounted for in the books except for the cash proceeds that were debited to the cash account and credited to a sale of vehicles account.

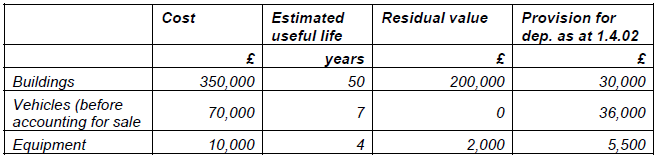

(d) No charge for provision for depreciation has been made in the accounts for the current year. Information in respect of non-current assets is as follows:

All assets are to be depreciated on a straight-line basis.

Ricksu€™s profit for the period ended 31.3.03 before the above adjustments was £78,900.

Required:

Show the entries in the ledger accounts to make the above adjustments; recalculate the profit for the period and show relevant extracts from the statement of financial position.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: