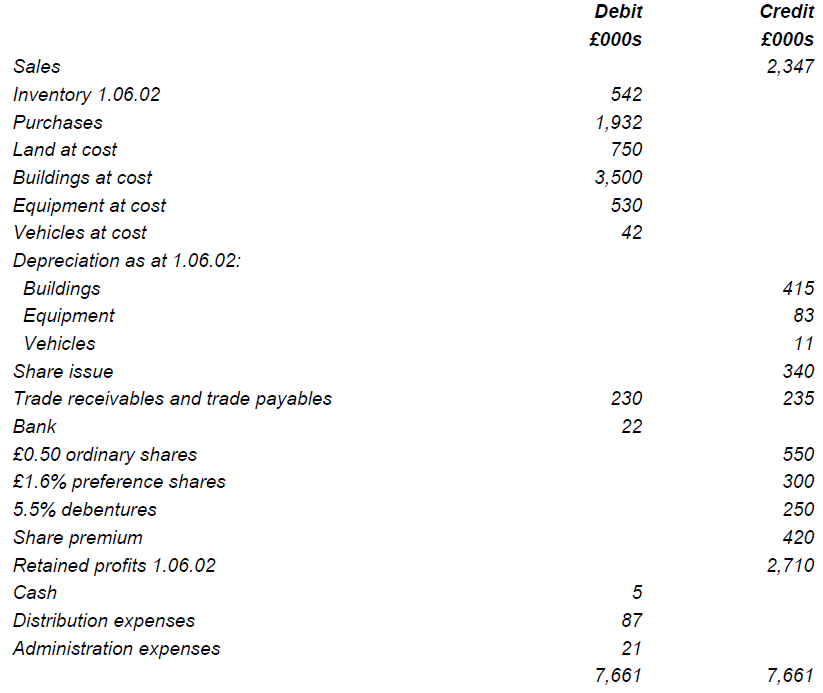

The following trial balance was extracted from the books of Marric Ltd. as at 31.05.03 The following

Question:

The following information has not been accounted for:

1. Closing inventory as at 31.05.03 is £497,000

2. Depreciation is to be charged at 2% straight line on buildings, 10% straight line on equipment and 25% reducing balance vehicles. Assets are used at 50% cost of sales, 25% distribution and 25% administration except for vehicles that are solely used for distribution.

3. Land is to be revalued to £1,000,000

4. Taxation for the year is estimated at £47,000

5. Preference dividends are to be paid in full

6. Debenture interest has not yet been paid

7. Dividends of 4p per ordinary share are declared

8. A provision for bad debts of 6% is to be allowed for

9. During the year, a further issue of 50p ordinary shares had been made at a premium of £1.20. The proceeds of the issue were debited to the bank account and credited to a share issue account. These new shares did not rank for dividend.

Required:

(a) Prepare the income statement and the statement of financial position as at 31.05.03 in a form suitable for publication for Marric Ltd.

(b) Explain the difference between the ordinary shares and the preference shares and why a share premium account needs to be created.

Step by Step Answer: