The summarised statements of financial position for two business entities are presented below: Sharp Photographics is considering

Question:

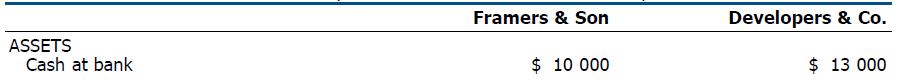

The summarised statements of financial position for two business entities are presented below:

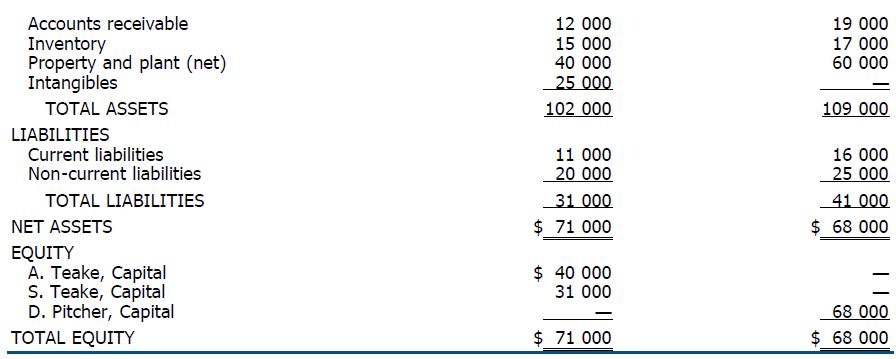

Sharp Photographics is considering the possibility of acquiring the businesses of Framers & Son and Developers & Co., and is interested in establishing an appropriate purchase price for making offers to the two entities. An assessment of the fair values of the entities’ assets is as follows:

The owners of Framers & Son are prepared to sell their firm at a price of 160% of the carrying amount of the entity’s net assets, and the owner of Developers & Co. is prepared to sell at 180% of the carrying amount of the net assets of his business. The owners of Sharp Photographics examined the earnings records and financial positions of the two entities over a number of years, and offered to pay the price required by Framers & Son, but offered to pay only 120% of the fair value of Developers & Co.’s net assets.

Required

A. Calculate the selling price being asked by each business and the purchase price offered by Sharp Photographics. Should each business sell out to Sharp Photographics?

B. The sale between Sharp Photographics and Framers & Son went ahead at the negotiated price; and the eventual sale price of Developers & Co. was $121 300. How much goodwill (if any) should be recognised by Sharp Photographics? Calculate the total valuations for all assets acquired from both businesses. Explain.

Step by Step Answer:

Financial Accounting

ISBN: 9781118608203

9th Edition

Authors: John Hoggett, Lew Edwards, John Medlin, Keryn Chalmers, Jodie Maxfield, Andreas Hellmann, Claire Beattie