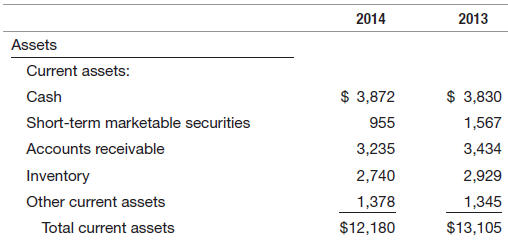

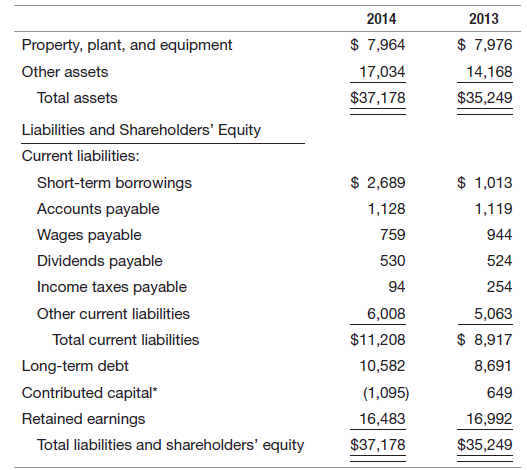

You are considering investing in Eli Lilly, a major pharmaceutical company. As part of your investigation of

Question:

*Net, including treasury stock and other adjustments. Assume shares outstanding were 17,000 throughout 2016 and 22,000 at year end 2017.

*Net, including treasury stock and other adjustments. Assume shares outstanding were 17,000 throughout 2016 and 22,000 at year end 2017.REQUIRED:

a. Compute the dollar change in each account from 2013 to 2014. Also compute the percentage change in each account from 2013 to 2014.

b. Convert the balance sheets to common-size balance sheets. Also compute the percentage change in the common-size numbers of each account from 2013 to 2014.

c. Does the information in (b) provide any additional data to that in (a)? Explain.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: