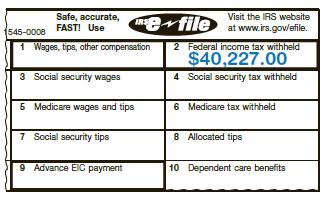

Question: Determine the correct entry for Box 1 assuming that the taxpayer pays 33% of his total income in federal taxes. 1545-0008 Safe, accurate, FAST! Use

Determine the correct entry for Box 1 assuming that the taxpayer pays 33% of his total income in federal taxes.

1545-0008 Safe, accurate, FAST! Use 1 Wages, tips, other compensation 3 Social security wages 5 Medicare wages and tips 7 Social security tips e file 9 Advance EIC payment Visit the IRS website at www.irs.gov/efile. 2 Federal income tax withheld $40,227.00 4 Social security tax withheld 6 Medicare tax withheld 8 Allocated tips 10 Dependent care benefits

Step by Step Solution

3.35 Rating (167 Votes )

There are 3 Steps involved in it

ANSWER Based on the information provided the correct entry for Box 1 would be the taxpayers total income before any taxes or deductions are taken out Unfortunately the information needed to determine this is not provided in the given list Box 1 is used to report the total amount of wages tips and other compensation that an employee received during the year This includes all income before any taxes or deductions are taken out To determine the correct entry for Box 1 you would need to know the taxpayers total income for the year Once you have that information you would simply enter it into Box 1 However it is important to note that the 33 tax rate mentioned in the question is only relevant for calculating the amount of federal income tax that the taxpayer ... View full answer

Get step-by-step solutions from verified subject matter experts