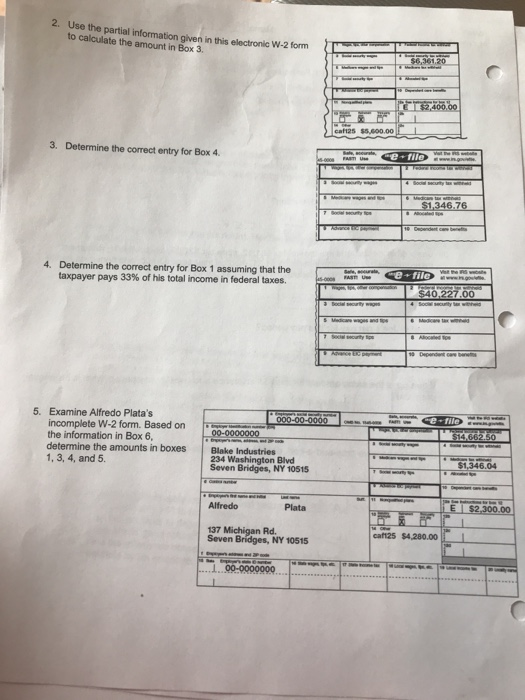

Question: 2. Use the partial information given in this electronic W-2 form to calculate the amount in Box 3. caf125 $5,600.00 3. Determine the correct entry

2. Use the partial information given in this electronic W-2 form to calculate the amount in Box 3. caf125 $5,600.00 3. Determine the correct entry for Box 4 Determine the correct entry for Box 1 assuming that the taxpayer pays 33% of his total income in federal taxes. 4. e fil Examine Alfredo Plata's incomplete W-2 form. Based on the information in Box 6, determine the amounts in boxesBlake Industries 1, 3, 4, and 5 5. $1,346.04 234 Washington Blvd Seven Bridges, NY 10515 $2.300.00 Alfredo Plata 137 Michigan Rd Seven Bridges, NY 10515 caf125 $4,280.00I 2. Use the partial information given in this electronic W-2 form to calculate the amount in Box 3. caf125 $5,600.00 3. Determine the correct entry for Box 4 Determine the correct entry for Box 1 assuming that the taxpayer pays 33% of his total income in federal taxes. 4. e fil Examine Alfredo Plata's incomplete W-2 form. Based on the information in Box 6, determine the amounts in boxesBlake Industries 1, 3, 4, and 5 5. $1,346.04 234 Washington Blvd Seven Bridges, NY 10515 $2.300.00 Alfredo Plata 137 Michigan Rd Seven Bridges, NY 10515 caf125 $4,280.00I

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts