Davros, Inc., makes tea kettles for kitchen and department store sales. Tony Davros, the president of the

Question:

Davros, Inc., makes tea kettles for kitchen and department store sales. Tony Davros, the president of the company, has decided it is time for him to begin budgeting as his business is growing by leaps and bounds due to Davros tea kettles’ unique designs. Each tea kettle is made from stainless steel. It takes roughly two pounds of stainless steel to make each tea kettle as well as an accessories kit that includes the knob for the lid, the handles, and a spout whistle. The major cost comes from forming the tea kettles, so machining and labor are high. The company also employs one designer who develops all of the innovative products that Davros sells.

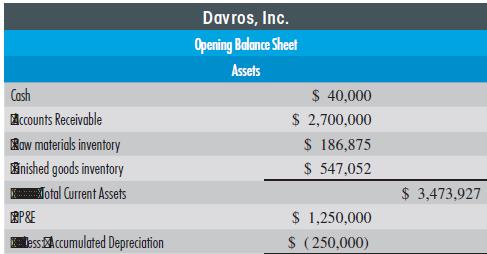

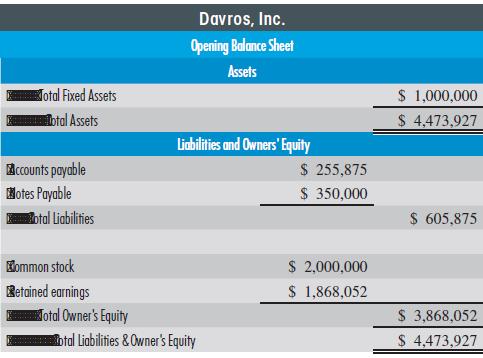

The opening balance sheet for Davros, Inc., is shown below. Each tea kettle sells for $45.

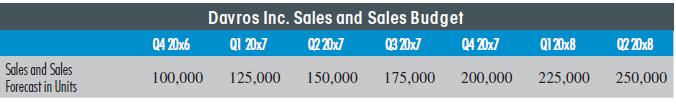

Sales for last year’s ending quarter and for the coming six quarters are in the table below.

Sales for last year’s ending quarter and for the coming six quarters are in the table below. • 40% of the company ’s customers pay in the quarter they receive the goods. The other 60% pay in the following quarter.

• 40% of the company ’s customers pay in the quarter they receive the goods. The other 60% pay in the following quarter.

• The company keeps 20% of the next quarter’s sales on hand in ending inventory.

• The stainless steel, which is of the highest quality, costs $2.50 per pound. The accessories kits cost $0.75 each.

• Raw materials purchases are paid 60% in the quarter of purchase, and 40% in the next quarter.

• Raw materials ending inventories are kept at 25% of the next quarter’s production demand.

• It takes 30 minutes to make one tea kettle. Labor is paid $30 per hour because they are fine metal workers, a dying trade.

• Variable overhead is $1.25 per unit. Fixed overhead for manufacturing per quarter includes $6,000 for rent, $12,000 for the metal-working machines (half of which is depreciation), $10,000 for supervision, and $2,500 for miscellaneous.

• Variable selling costs are $1 per unit. Fixed quarterly SG&A costs include $10,000 for the designer, $12,000 for marketing, $8,000 for administrative costs, and $4,000 for general overhead.

• Income taxes are 35% of income before taxes.

REQUIRED:

For the coming year, complete:

a. A sales budget

b. A production budget

c. A raw materials budget for each raw material used to make the tea kettles

d. A labor budget

e. An overhead budget

f. An ending finished goods budget

g. A cost of goods sold budget

h. An SG&A budget

i. An income statement

j. A cash receipts budget

k. A cash disbursements budget

l. A cash budget

m. An ending balance sheet

Step by Step Answer:

Managerial Accounting An Integrative Approach

ISBN: 9780999500491

2nd Edition

Authors: C J Mcnair Connoly, Kenneth Merchant