Judy Holmes, owner and primary manager of Holmes Industry, has recently completed a course in management accounting.

Question:

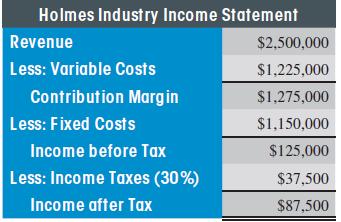

Judy Holmes, owner and primary manager of Holmes Industry, has recently completed a course in management accounting. She has decided to try to take a look at her company, which makes a variety of sink faucets, from the perspective of its cost structure as well as the impact various ideas she has been having would have on profitability. The following is her income statement for last year restated in the variable costing format. This year looks like it will be similar to last year unless she makes some positive changes. Having pulled this basic information together with the help of her accountant, Larry Black, Judy decides to hold a meeting of top management to look at various options. The following discussions occur:

Having pulled this basic information together with the help of her accountant, Larry Black, Judy decides to hold a meeting of top management to look at various options. The following discussions occur:

Judy : I’ve brought all of you together to see if we can find ways to improve the company ’s performance. We are currently only making 3.75% in after- tax profit on over $2,500,000 in sales. We’re moving 100,000 unit s at $25 per unit , which isn’t bad, but the profits aren’t there. We’ve got a pretty small margin, especially since my entire salary is based on these results.

Martin, VP Marketing: Judy, you know my feeling. We need to lower the price of our faucets if we’re going to get a sales bump. The big box stores need that price concession from us or it’s no go for them. I think we should lower prices 10% across the board.

Judy: If all we do is lower prices, Martin, how will that help us? Basically, I’m not saying no, but I do want to figure out what that would do to our margins and breakeven sales. Have you calculated how lower prices would impact sales?

Martin: I’ve run a few projections. I think we could raise sales to 125,000 units if we reduce our average price to $22.50. That would increase our total revenues by $312,500 to $2,812,500. That’s a 12.5% increase.

Larry, Finance: I’m not so sure that’s so good, unless we can find a way to bring the costs per unit down. Right now they ’re 95% of the total sales dollar. The variable portion of that is 49%, or $12.25. That won’t change unless we make some major shifts to how we make the faucets, which could be dangerous.

Sam, VP Manufacturing: I don’t know, Larry. I think I could shave 5% of the variable costs if Judy would let me buy the new machine I want. Sure, the machine would be an out lay of $1,000,000, but it has a 10- year useful life, so that would only ramp up fixed costs a bit.

Judy: These are two big changes we’re talking about. I was hoping for something a little less risky than cutting prices or buying new machines. Aren’t there any other ideas? Mart in: Well, I’ve got ten some inquiries from a small hardware chain. They would like to buy 10,000 units, one time, for $20. That wouldn’t change our price to the rest of the market , but would just generate some additional sales. I could look for these types of opportunities.

Larry: You think you can drop prices that much to one small customer and not have the word get around? Sounds risky to me!

Judy: Tell you what. I’ll analyze the impact of each of your suggestions and we can talk them over at next week’s meeting.

Step by Step Answer:

Managerial Accounting An Integrative Approach

ISBN: 9780999500491

2nd Edition

Authors: C J Mcnair Connoly, Kenneth Merchant