Rubens Company makes a number of special-edition glass perfume bottles. Each year, the company comes out with

Question:

Rubens Company makes a number of special-edition glass perfume bottles. Each year, the company comes out with a new set of 12 bottles, which customers can buy either one at a time or as a set. The company uses target costing to set the price for the items, which are directly distributed to customers if purchased as a set, or sold through retail outlets as single bottles. The retail price of the individual bottles is $25. There is a 40% markup in the industry, so Rubens gets $15 per bottle. It sells the set of 12 for $240, or $20 per bottle. For practical purposes, the target price is set at $15 per bottle.

The target profit for each annual run of 250,000 sets of 12 is 50%. This has to cover development, marketing, internal operations costs, management salaries, and profit for the company. Since this is a highly competitive industry, one where customers can easily be lost if quality is not perfect, significant time is spent on developing attractive, highly protective packaging. The packaging accounts for 10% of the total manufacturing cost.

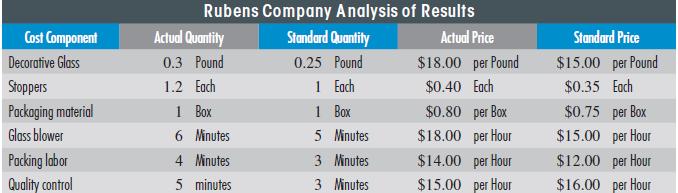

Based on current production, it appears that Rubens is not going to make its target cost. Quality problems have added to the problem. The actual vs. standard information for production is presented in the following table.

REQUIRED:

a. Compute the target cost.

b. Compute the current actual cost.

c. Compute the cost gap.

d. Compute the variances for all of the cost elements.

e. Where should Rubens focus its attention in getting its costs under control?

Step by Step Answer:

Managerial Accounting An Integrative Approach

ISBN: 9780999500491

2nd Edition

Authors: C J Mcnair Connoly, Kenneth Merchant