The directors of Fruit Sales plc produced the following income statement (profit and loss account) for Year

Question:

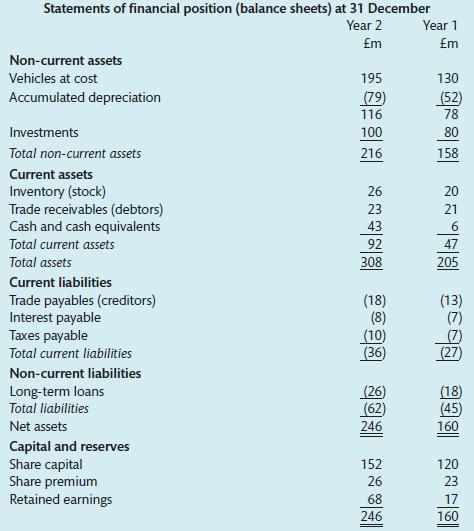

The directors of Fruit Sales plc produced the following income statement (profit and loss account) for Year 2 and balance sheet at the end of Year 2.

Income statement for Year 2

.................................................................................................................................................. £m

Revenue .................................................................................................................................. 320

Cost of sales .......................................................................................................................... (143)

Gross profit............................................................................................................................... 177

Investment income – interest received ................................................................................... 5

Gain on disposal of equipment.................................................................................................. 7

Depreciation .............................................................................................................................. (39)

Administrative and selling expenses ...................................................................................... (13)

Operating profit before interest.............................................................................................. 137

Interest expense ...................................................................................................................... (20)

Profit after deducting interest .............................................................................................. 117

Taxation .................................................................................................................................... (35)

Profit after tax ..............................................................................................................................82

Further information

1. The dividend paid during Year 2 was £31m. The retained earnings increased by £82m profit of the period and decreased by the amount of the dividend £31m.

2. During Year 2 the company acquired vehicles costing £90m.

3. During Year 2 the company sold vehicles that had an original cost of £25m and accumulated depreciation of £12m. The proceeds of sale were £20m.

4. Cost of sales consists entirely of purchases of fruit on credit from suppliers. Wages are included in administrative and selling expenses and are paid when incurred.

Required:-

1. Prepare a statement of cash flows using (a) the direct method and (b) the indirect method of calculating operating cash flow.

2. Write a comment on the cash flow of the period.

Step by Step Answer:

Financial And Management Accounting An Introduction

ISBN: 9781292244419

8th Edition

Authors: Pauline Weetman