Tools Ltd is a new business which has been formed to buy standard machine tool units and

Question:

Tools Ltd is a new business which has been formed to buy standard machine tool units and adapt them to the specific needs of customers.

The business will acquire fixed assets costing £100,000 and a stock of 500 standard tool units on the first day of business. The fixed assets are expected to have a five-year life with no residual value at the end of that time.

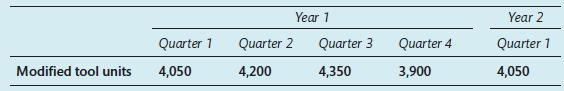

Sales are forecast as follows:

The selling price of each unit will be £90.

The cost of production of each unit is specified as follows:

£

Cost of standard unit purchased ......................... 24

Direct labour ........................................................... 30

Fixed overhead ........................................................10

64

The fixed overhead per unit includes an allocation of depreciation. The annual depreciation is calculated on a straight-line basis and is allocated on the basis of a cost per unit to be produced during the year.

Suppliers of standard tool units will allow one month’s credit. Customers are expected to take two months’ credit. Wages will be paid as they are incurred in production. Fixed overhead costs will be paid as they are incurred. The stock of finished goods at the end of each quarter will be su cient to satisfy 10% of the planned sales of the following quarter. The stock of standard tool units will be held constant at 500 units. It may be assumed that the year is divided into quarters of equal length and that sales, production and purchases are spread evenly throughout any quarter.

Required

Produce, for each quarter of the first year of trading:

(a). The sales budget;

(b). The production budget; and

(c). The cash budget.

Step by Step Answer:

Financial And Management Accounting An Introduction

ISBN: 9781292244419

8th Edition

Authors: Pauline Weetman