Question: On January 1, 2025, Cullumber Inc. issued a 10-year, $530,000 note at 8% fixed interest, interest payable semiannually. Cullumber preferred a variable-rate note, but

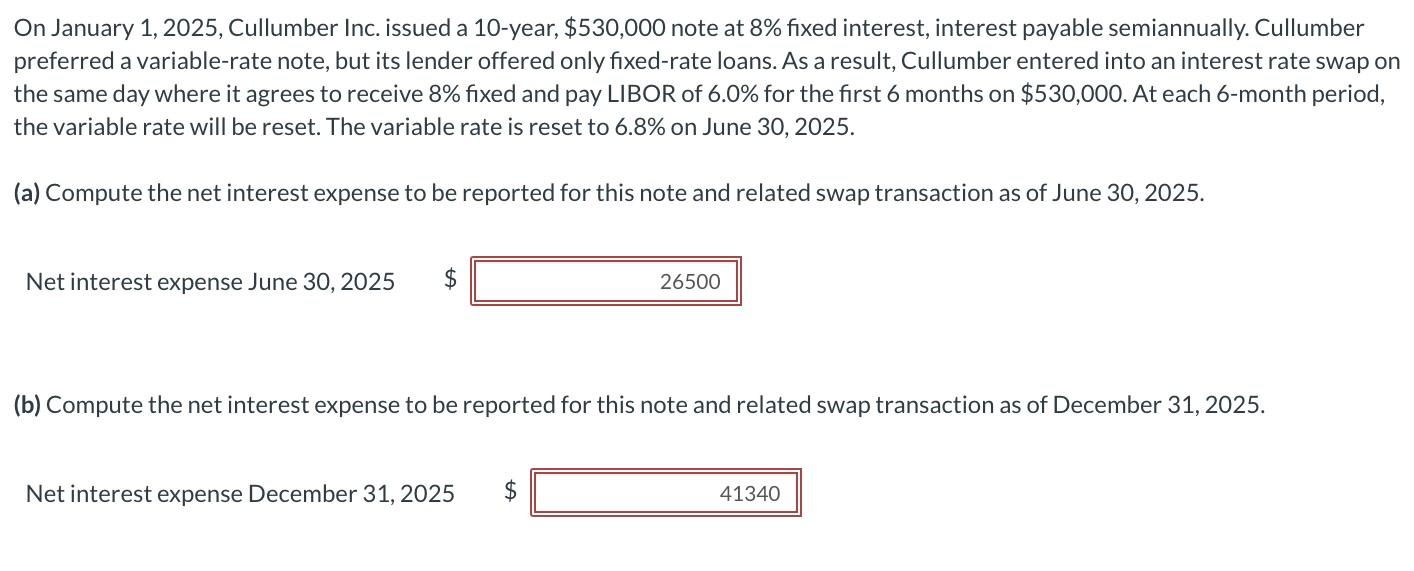

On January 1, 2025, Cullumber Inc. issued a 10-year, $530,000 note at 8% fixed interest, interest payable semiannually. Cullumber preferred a variable-rate note, but its lender offered only fixed-rate loans. As a result, Cullumber entered into an interest rate swap on the same day where it agrees to receive 8% fixed and pay LIBOR of 6.0% for the first 6 months on $530,000. At each 6-month period, the variable rate will be reset. The variable rate is reset to 6.8% on June 30, 2025. (a) Compute the net interest expense to be reported for this note and related swap transaction as of June 30, 2025. Net interest expense June 30, 2025 $ (b) Compute the net interest expense to be reported for this note and related swap transaction as of December 31, 2025. Net interest expense December 31, 2025 26500 $ 41340

Step by Step Solution

3.45 Rating (152 Votes )

There are 3 Steps involved in it

a For the period from January 1 2025 to June 30 2025 the net interest expense to be reported ... View full answer

Get step-by-step solutions from verified subject matter experts