Question: Bank of America Corporation (BAC) and Wells Fargo & Company (WFC) are two large financial services companies. The following data (in millions) were taken from

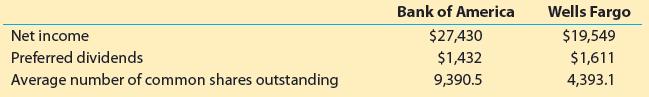

Bank of America Corporation (BAC) and Wells Fargo & Company (WFC) are two large financial services companies. The following data (in millions) were taken from a recent year’s financial statements for both companies:

a. Compute the earnings per share for both companies.

b. Which company appears to be more profitable on an earnings-per-share basis?

c. Which company would you expect to have the larger quoted market price?

Net income Preferred dividends Average number of common shares outstanding Bank of America $27,430 $1,432 9,390.5 Wells Fargo $19,549 $1,611 4,393.1

Step by Step Solution

3.49 Rating (166 Votes )

There are 3 Steps involved in it

a Earnings per Share Net Income Preferred Dividends Average Number of Common Shares Outs... View full answer

Get step-by-step solutions from verified subject matter experts