Consider the following income tax footnote information for the E. I. du Pont de Nemours and Company.

Question:

Consider the following income tax footnote information for the E. I. du Pont de Nemours and Company.

Required

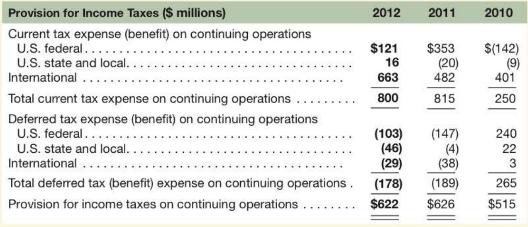

a. What is the total amount of income tax expense that DuPont reports in its 2012 income statement?

What portion of this expense did DuPont pay during 2012 or expect to pay in 2013 ?

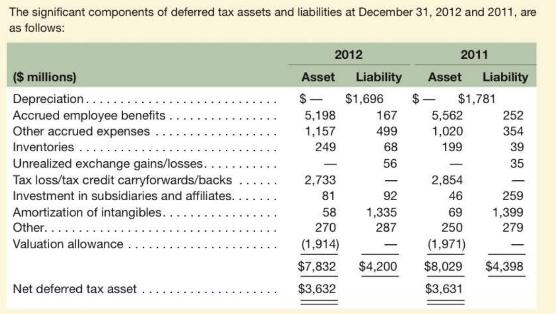

b. Explain how the deferred tax liability called "depreciation" arises. Under what circumstances will the company settle this liability? Under what circumstances might this liability be deferred indefinitely?

c. Explain how the deferred tax asset called "accrued employee benefits" arises. Why is it recognized as an asset?

d. Explain how the deferred tax asset called "tax loss/tax credit carryforwards/backs" arises. Under what circumstances will DuPont realize the benefits of this asset?

e. DuPont reports a 2012 valuation allowance of \(\$ 1,914\) million. How does this valuation allowance arise? How did the change in valuation allowance for 2012 affect net income? Valuation allowances typically relate to questions about the realizability of tax loss carryforwards. Under what circumstances might DuPont not realize the benefits of its tax loss carryforwards?

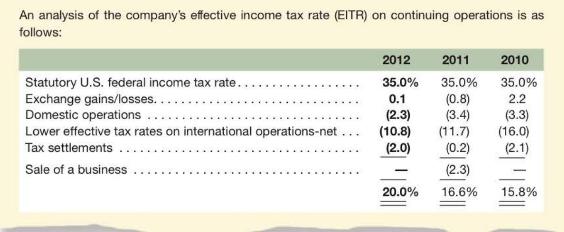

f. DuPont's footnote reports the effective income tax rates (EITR) for the three-year period. What explains the difference between the U.S. statutory rate and the company's EITR?

Step by Step Answer:

Financial And Managerial Accounting For MBAs

ISBN: 9781618533593

6th Edition

Authors: Peter D. Easton