Following are footnotes (excerpted) from the 10-K of Intuit, Inc. Required a. Describe the differences in revenue

Question:

Following are footnotes (excerpted) from the 10-K of Intuit, Inc.

Required

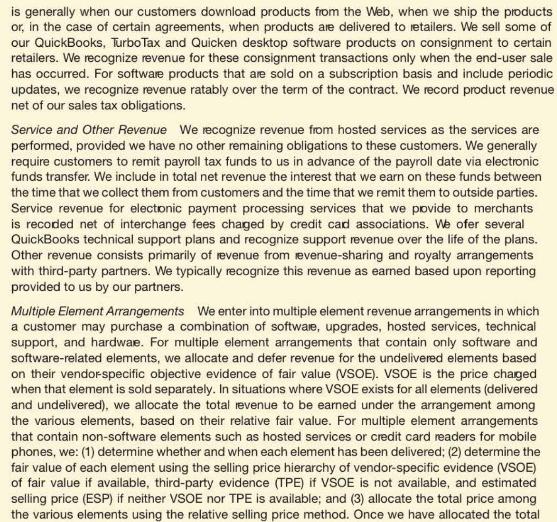

a. Describe the differences in revenue recognition between product sales and after-sale services. How does the company recognize revenue for consignment sales? For products sold on a subscription basis? How is service revenue recognized?

b. Some of the company's sales involve multiple element arrangements. In general, what are these arrangements? How does the company account for such sales?

c. Intuit reports \(\$ 685\) million of research and development expense, up from \(\$ 618\) million in the prior year.

i. What kind of research activities would we expect for a company like Intuit?

ii. Given the kind of research activities described in part i, how does the accounting for Intuit's \(R \& D\) costs differ from the way that those costs would have been accounted for had Intuit used IFRS for financial reporting?

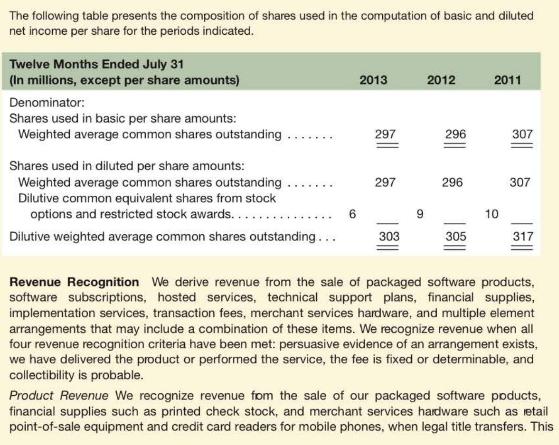

d. Intuit's earnings per share (EPS) is \$2.83 on a diluted basis, compared with its basic EPS of \$2.89. What factor(s) accounts for this dilution?

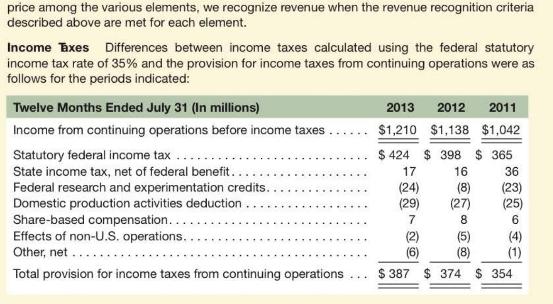

e. Drawing on Intuit's income tax footnote, prepare a table in percentages showing computation of its effective tax rate for each of the three fiscal years. What tax-related items, if any, would we not expect to continue into fiscal year 2014?

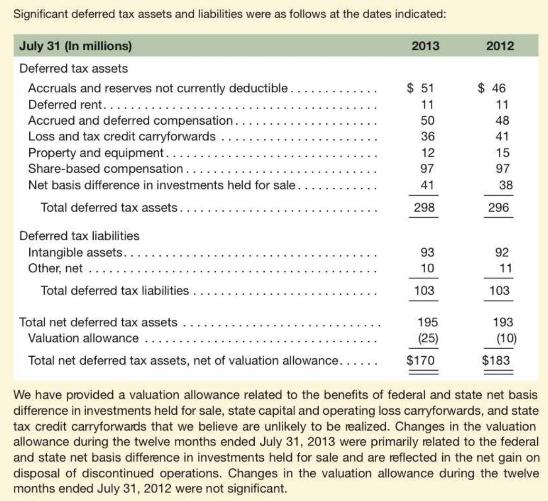

f. Intuit reports total net deferred tax assets of \(\$ 170\) million.

i. Describe how deferred tax assets relating to accruals arise.

ii. Explain how deferred tax assets relating to loss carryforwards arise.

iii. Intuit reports an increase of its deferred tax asset valuation allowance of \$15 million in 2013. How does this affect Intuit's income?

Step by Step Answer:

Financial And Managerial Accounting For MBAs

ISBN: 9781618533593

6th Edition

Authors: Peter D. Easton