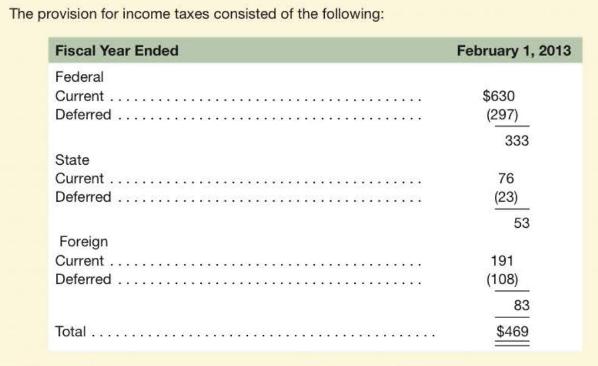

Dell Inc. reports the following footnote disclosure to its 2013 10-K report ($ millions). a. What amount

Question:

Dell Inc. reports the following footnote disclosure to its 2013 10-K report (\$ millions).

a. What amount of income tax expense does Dell report in its income statement for 2013?

b. How much of Dell's income tax expense is current (as opposed to deferred)?

c. Why do deferred tax assets and liabilities arise? How do they impact the tax expense that Dell reports in its 2013 income statement?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Financial And Managerial Accounting For MBAs

ISBN: 9781618533593

6th Edition

Authors: Peter D. Easton

Question Posted: