Financial statements often serve as a starting point in formulating budgets. Review Apples financial statements in Appendix

Question:

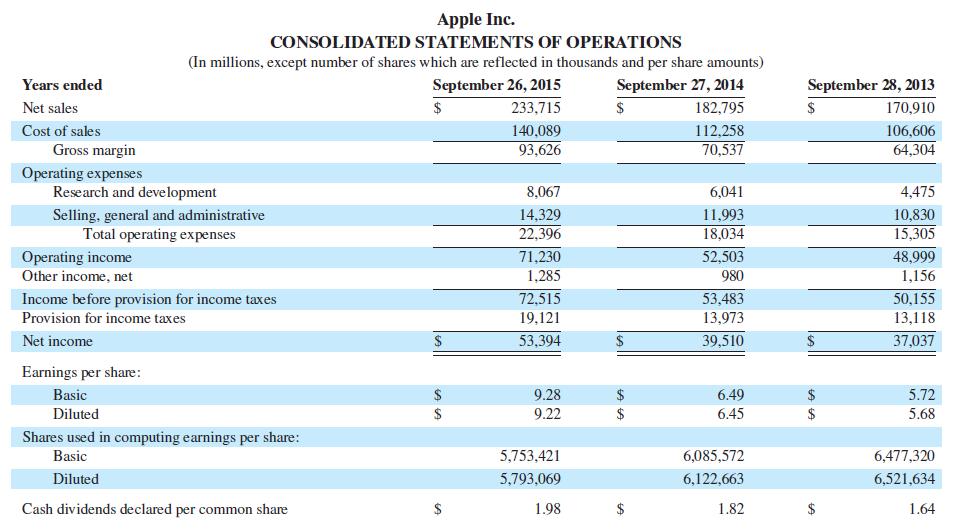

Financial statements often serve as a starting point in formulating budgets. Review Apple’s financial statements in Appendix A to determine its cash paid for acquisitions of property, plant, and equipment in the current year and the budgeted cash needed for such acquisitions in the next year.

Required 1. Which financial statement reports the amount of cash paid for acquisitions of property, plant, and equipment? Explain where on the statement this information is reported.

2. Indicate the amount of cash

(a) paid for acquisitions of property and equipment in the year ended September 26, 2015, and

(b) to be paid (budgeted for) next year under the assumption that annual acquisitions of property and equipment equal 20% of the prior year’s net income.

Fast Forward 3. Access Apple’s financial statements for a year ending after September 26, 2015, from either its website [Apple.com] or the SEC’s EDGAR database [SEC.gov]. Compare your answer for part 2 with actual cash paid for acquisitions of property and equipment for that fiscal year. Compute the error, if any, in your estimate. Speculate as to why cash paid for acquisitions of property and equipment was higher or lower than your estimate.

Data From Apple Financial Statement Appendix A

Companies often budget selling expenses and general and administrative expenses (SGA) as a

percentage of expected sales.

Required

1. For both Apple and Google, list the prior three years’ sales (in dollars) and total selling expenses and

general and administrative expenses (in dollars). Use the financial statements in Appendix A.

2. Compute the ratio of total selling expenses and general and administrative expenses to sales for each

of the three years.

3. Using the data from part 2, predict both companies’ total selling expenses and general and administrative

expenses (in dollars) for the next two years. (If possible, compare your predictions to actual

amounts for those years.)

Data From Appendix Apple Financial Statement

Step by Step Answer:

Financial And Managerial Accounting Information For Decisions

ISBN: 9781259726705

7th Edition

Authors: John Wild, Ken Shaw, Barbara Chiappetta