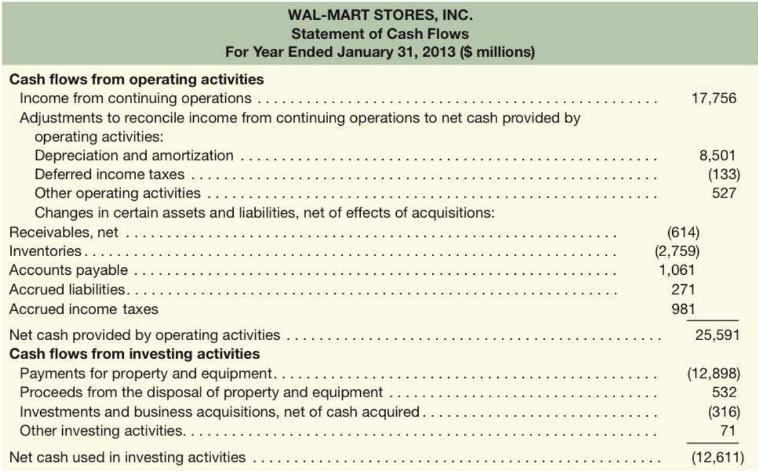

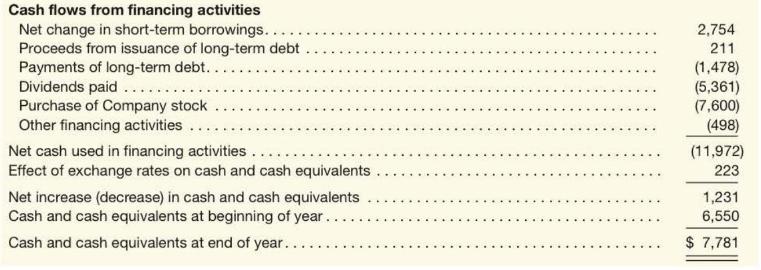

Following is the statement of cash flows for Wal-Mart Stores, Inc, Required a. Why does Wal-Mart add

Question:

Following is the statement of cash flows for Wal-Mart Stores, Inc,

Required

a. Why does Wal-Mart add back depreciation to compute net cash flows from operating activities?

b. Explain why the increase in receivables and inventories is reported as a cash outflow. Why do accounts payable and accrued liabilities provide a source of cash?

c. Wal-Mart reports that it invested $ 12,898 million in property and equipment. Is this an appropriate type of expenditure for Wal-Mart to make? What relation should expenditures for PPE assets have with depreciation expense?

d. Wal-Mart indicates that it paid \(\$ 7,600\) million to repurchase its common stock in fiscal 2013 and, in addition, paid dividends of $ 5,361 million. Thus, Wal-Mart paid $12,961 million of cash to its stockholders during the year. How do we evaluate that use of cash relative to other possible uses for Wal-Mart's cash?

e. Provide an overall assessment of Wal-Mart's cash flows for 2013. In the analysis, consider the sources and uses of cash.

Step by Step Answer:

Financial And Managerial Accounting For MBAs

ISBN: 9781618533593

6th Edition

Authors: Peter D. Easton