The 2012 income statement for Pfizer Inc. is reproduced in this module. Pfizer also reports the following

Question:

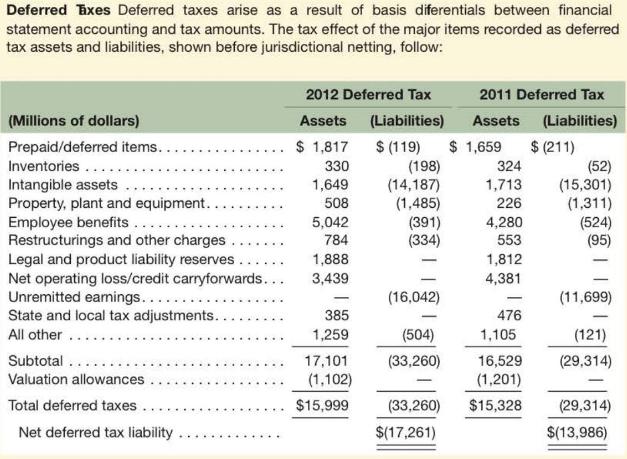

The 2012 income statement for Pfizer Inc. is reproduced in this module. Pfizer also reports the following footnote relating to its income taxes in its 2012 10-K report.

Required

a. Describe the terms "deferred tax liabilities" and "deferred tax assets." Provide an example of how these accounts can arise.

b. Intangible assets (other than goodwill) acquired in the purchase of a company are depreciated (amortized) similar to buildings and equipment (see Module 9 for a discussion). Describe how the deferred tax liability of \(\$ 14,187\) million relating to intangibles arose.

c. Pfizer has many employee benefit plans, such as a long-term health plan and a pension plan. Some of these are generating deferred tax assets and others are generating deferred tax liabilities. Explain the timing of the recognition of expenses under these plans that would give rise to these different outcomes.

d. Pfizer reports a deferred tax liability labelled "unremitted earnings." This relates to an investment in an affiliated company for which Pfizer is recording income, but has not yet received dividends. Generally, investment income is taxed when received. Explain what information the deferred tax liability for unremitted earnings conveys.

e. Pfizer reports a deferred tax asset relating to net operating loss carryforwards. Explain what loss carryforwards are.

f. Pfizer reports a valuation allowance of \(\$ 1,102\) million in 2012. Explain why Pfizer has established this allowance and its effect on reported profit. Pfizer's valuation allowance was \(\$ 1,201\) million in 2011. Compute the change in its allowance during 2012 and explain how that change affected 2012 tax expense and net income.

Step by Step Answer:

Financial And Managerial Accounting For MBAs

ISBN: 9781618533593

6th Edition

Authors: Peter D. Easton