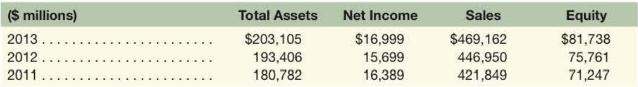

The following table contains financial statement information for Wal-Mart Stores, Inc. Required a. Compute the return on

Question:

The following table contains financial statement information for Wal-Mart Stores, Inc.

Required

a. Compute the return on equity (ROE) for 2012 and 2013. What trend, if any, is evident? How does Wal-Mart's ROE compare with the approximately \(21.5 \%\) median ROE for companies in the Dow Jones Industrial average for 2012?

b. Compute the return on assets (ROA) for 2012 and 2013. What trends, if any, are evident? How does Wal-Mart's ROA compare with the approximate \(6.7 \%\) median ROA for companies in the Dow Jones Industrial average for 2012?

c. What factors might allow a company like Wal-Mart to reap above-average returns?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Financial And Managerial Accounting For MBAs

ISBN: 9781618533593

6th Edition

Authors: Peter D. Easton

Question Posted: