You are a loan officer with Third Nebraska Bank. Joe West owns two restaurants that are organized

Question:

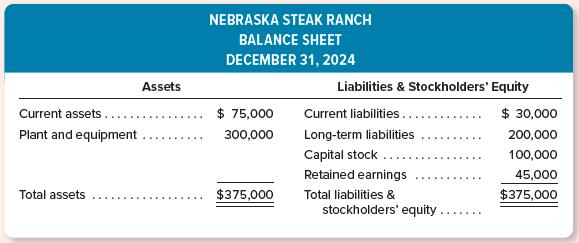

You are a loan officer with Third Nebraska Bank. Joe West owns two restaurants that are organized as two separate companies. Each company has applied to your bank for a $250,000 one-year loan for the purpose of opening an additional location. Condensed balance sheets for the two business entities are shown as follows:

Both restaurants are popular and have been successful over the past several years. Nebraska Steak Ranch has been slightly more profitable, but the operating results for the two businesses have been quite similar. You think that either restaurant’s second location has the potential to be successful. On the other hand, you know that restaurants are a “faddish” type of business and that their popularity and profitability can change very quickly. Joe West is one of the wealthiest people in Nebraska. He made a fortune—estimated at more than $2 billion—as the founder of Micro Time, a highly successful manufacturer of computer software. West now is retired and spends most of his time at Second Life, his 50,000-acre cattle ranch. Both of his restaurants are run by experienced professional managers.

Instructions

a. Compute the current ratio and working capital of each business entity.

b. On the basis of the information provided in this case, which of these businesses do you consider to be the better credit risk? Explain fully.

c. What simple measure might you insist upon that would make the other business as good a credit risk as the one you identified in part b? Explain.

Step by Step Answer:

Financial And Managerial Accounting The Basis For Business Decisions

ISBN: 9781264445240

20th Edition

Authors: Jan Williams, Susan Haka, Mark Bettner