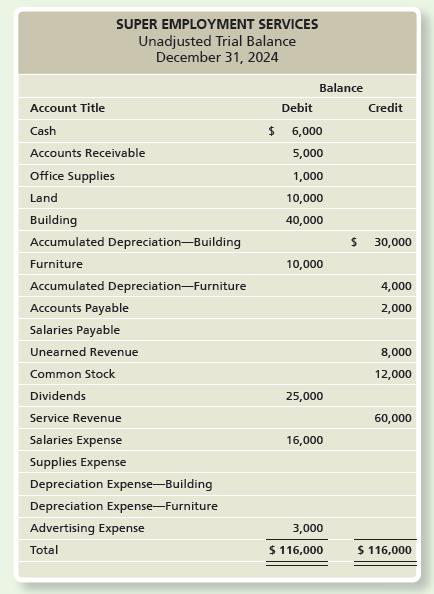

The unadjusted trial balance as of December 31, 2024, the end of the annual accounting period for

Question:

The unadjusted trial balance as of December 31, 2024, the end of the annual accounting period for Super Employment Services, follows

Data needed for the adjusting entries include the following:

a. Office Supplies on hand at year-end, $200.

b. Depreciation on furniture, $2,000.

c. Depreciation on building, $1,000.

d. Salaries owed but not yet paid, $500.

e. Accrued service revenue, $1,300.

f. $3,000 of the unearned revenue has been earned.

Requirements

1. Open the ledger accounts in T-account form with their unadjusted balances as shown on the unadjusted trial balance.

2. Journalize Super’s adjusting entries at December 31, 2024. Use the letter (a, b, and so on) as the date.

3. Post the adjusting entries to T-accounts. Determine the ending balances in the T-accounts on December 31, 2024.

4. Prepare an adjusted trial balance.

5. Prepare a partial worksheet including the account names, unadjusted trial balance, adjustments, and adjusted trial balance.

Step by Step Answer:

Horngrens Financial And Managerial Accounting The Financial Chapters

ISBN: 9781292412320

7th Global Edition

Authors: Tracie Miller-Nobles, Brenda Mattison, Ella Mae Matsumura