Refer again to the financial institution in problem 26. a. What is the change in the value

Question:

Refer again to the financial institution in problem 26.

a. What is the change in the value of the firm’s assets for relative upward shift in the entire yield curve of 0.5 percent?

b. What is the change in the value of the firm’s liabilities for relative upward shift in the entire yield curve of 0.4 percent?

c. What is the resulting change in the value of equity for the firm?

Data from Problem 26:

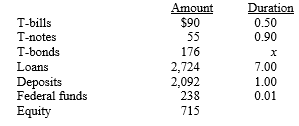

The following balance sheet information is available (amounts in thousands of dollars and duration in years) for a financial institution:

Treasury bonds are five-year maturities paying 6 percent semiannually and selling at par.

Balance SheetBalance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Financial Institutions Management A Risk Management Approach

ISBN: 978-1259717772

9th edition

Authors: Anthony Saunders, Marcia Millon Cornett

Question Posted: