County Bank has the following market value balance sheet (in millions, all interest at annual rates). All

Question:

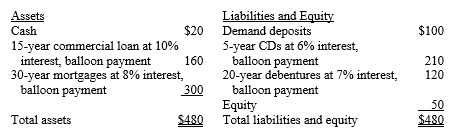

County Bank has the following market value balance sheet (in millions, all interest at annual rates). All securities are selling at par equal to book value.

a. What is the maturity gap for County Bank?

b. What will be the maturity gap if the interest rates on all assets and liabilities increase by 1 percent?

c. What will happen to the market value of the equity?

Balance SheetBalance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial... Maturity

Maturity is the date on which the life of a transaction or financial instrument ends, after which it must either be renewed, or it will cease to exist. The term is commonly used for deposits, foreign exchange spot, and forward transactions, interest...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Financial Institutions Management A Risk Management Approach

ISBN: 978-1259717772

9th edition

Authors: Anthony Saunders, Marcia Millon Cornett

Question Posted: