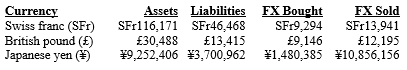

The following are the foreign currency positions of an FI, expressed in the foreign currency. The exchange

Question:

The following are the foreign currency positions of an FI, expressed in the foreign currency.

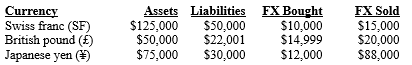

The exchange rate of dollars per SFrs is 1.0760, of dollars per British pounds is 1.6400, and of dollars per yen is 0.0081060.

The following are the foreign currency positions converted to dollars

a. What is the FI’s net exposure in Swiss francs stated in SFr and in $s?

b. What is the FI’s net exposure in British pounds stated in £ and in $s?

c. What is the FI’s net exposure in Japanese yen stated in ¥s and in $s?

d. What is the expected loss or gain if the SF exchange rate appreciates by 1 percent? State you answer in SFs and $s.

e. What is the expected loss or gain if the £ exchange rate appreciates by 1 percent? State you answer in £s and $s.

f. What is the expected loss or gain if the ¥ exchange rate appreciates by 2 percent? State you answer in ¥s and $s.

Exchange RateThe value of one currency for the purpose of conversion to another. Exchange Rate means on any day, for purposes of determining the Dollar Equivalent of any currency other than Dollars, the rate at which such currency may be exchanged into Dollars...

Step by Step Answer:

Financial Institutions Management A Risk Management Approach

ISBN: 978-1259717772

9th edition

Authors: Anthony Saunders, Marcia Millon Cornett