Larkin Conglomerates plc owns a subsidiary, Hughes Ltd, which sells office equipment. Recently, Larkin Conglomerates plc has

Question:

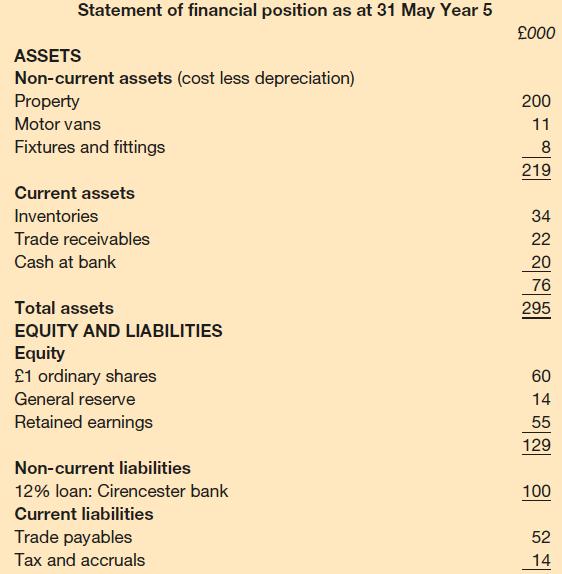

Larkin Conglomerates plc owns a subsidiary, Hughes Ltd, which sells office equipment.

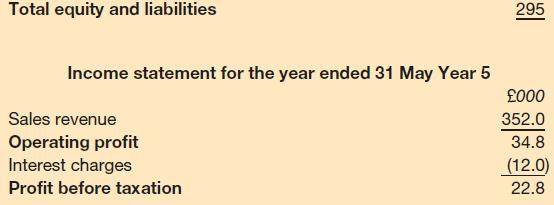

Recently, Larkin Conglomerates plc has been reconsidering its future strategy and has decided that Hughes Ltd should be sold off. The proposed divestment of Hughes Ltd has attracted considerable interest from other businesses wishing to acquire this type of business. The most recent financial statements of Hughes Ltd are as follows:

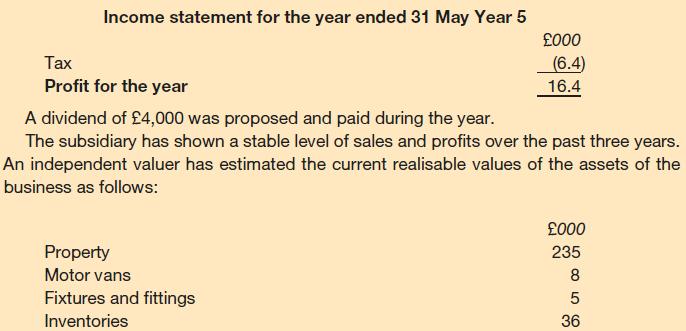

For the remaining assets, the statement of financial position values reflect their current realisable values.

Another business in the same industry, which is listed on the Stock Exchange, has a dividend yield of 5 per cent and a price/earnings ratio of 12. Assume a tax rate of 25 per cent.

Required:

(a) Calculate the value of an ordinary share in Hughes Ltd using the following methods:

(i) net assets (liquidation) basis (ii) dividend yield (iii) price/earnings ratio.

(b) Briefly state what other information, besides the information provided above, would be useful to prospective buyers in deciding on a suitable value to place on the shares of Hughes Ltd.

Step by Step Answer: