The directors of Simat plc have adopted a policy of expansion based on the acquisition of other

Question:

The directors of Simat plc have adopted a policy of expansion based on the acquisition of other businesses. The special projects division of Simat has been given the task of identifying suitable businesses for takeover.

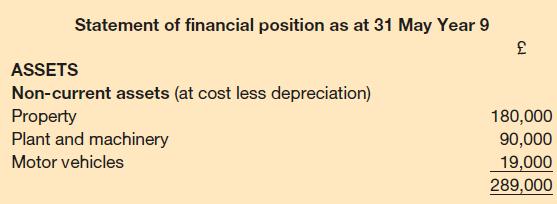

Stidwell Ltd has been identified as being a suitable business and negotiations between the board of directors of each business have begun. Information relating to Stidwell Ltd is set out below:

Stidwell Ltd’s profit for the year ended 31 May Year 9 was £48,500 and the dividend paid for the year was £18,000. Profits and dividends of the business have shown little change over the past five years.

The realisable values of the assets of Stidwell Ltd, at the end of the year, were estimated to be as follows:

For the remaining assets, the values as per the statement of financial position were considered to reflect current realisable values.

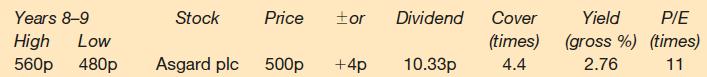

The special projects division of Simat plc has also identified another business, Asgard plc, which is listed on the Stock Exchange and is broadly similar to Stidwell Ltd. The following details were taken from a recent copy of a financial newspaper:

Required:

Calculate the value of an ordinary share of Stidwell Ltd using each of the following valuation methods:

(a) net assets (liquidation) basis

(b) dividend yield

(c) price/earnings ratio.

Step by Step Answer: