Larunda plc operates a shipyard in the UK and has recently completed the building of a passenger

Question:

Larunda plc operates a shipyard in the UK and has recently completed the building of a passenger ferry for a French business. The ferry has successfully completed its sea trials and final payment of €20 million is due to Larunda plc in three months’ time. The board of directors of Larunda plc will soon meet to decide whether, and if so, how, to hedge against the currency risk to which the business will be exposed.

Over the past few months there has been considerable volatility in the currency markets. As a result, the value of the euro has changed frequently against most major currencies, including the £ sterling. This period of volatility is set to continue and it is by no means clear how the euro will perform against major currencies, at least in the short term.

Faced with this uncertainty, three possible options are being explored by Larunda plc:

(i) To bear the currency risk by doing nothing.

(ii) To hedge against the risk by using a currency option. An over-the-counter option may be bought from a bank at a premium cost of £1.10 per €100 and at an exercise price of £1 = :1.19.

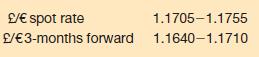

(iii) To hedge against the risk by taking out a forward exchange contract. Exchange rates are:

Required:

(a) Show the financial result of each of the three options being explored, assuming that the exchange rate in three months’ time will be:

(i) £1 = €1.1208

(ii) £1 = €1.2432

(b) Discuss the financial results calculated in (a) above.

(c) Outline the main advantages and disadvantages of each of the options that Larunda plc is considering.

Step by Step Answer: