Mojave plc supplies frozen desserts to supermarkets and restaurant chains throughout the UK. The business has enjoyed

Question:

Mojave plc supplies frozen desserts to supermarkets and restaurant chains throughout the UK. The business has enjoyed strong growth since it was formed six years ago and is now considering a listing on the Stock Exchange. At a forthcoming meeting of the board of directors, the likely price of the business’s shares upon listing is one of the key items on the agenda.

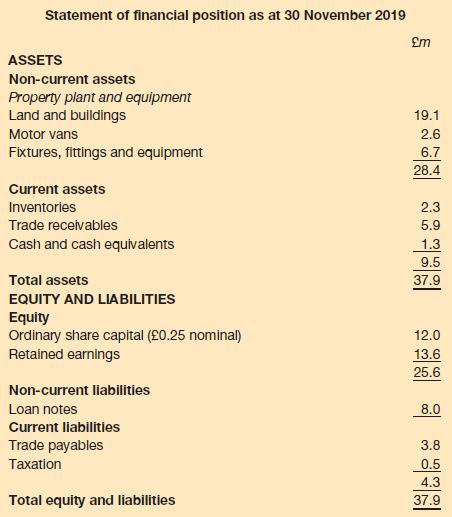

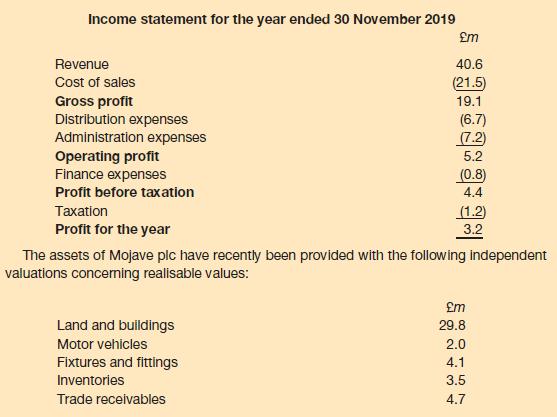

The draft financial statements for Mojave plc for the most recent financial year are set out below:

The following additional information is also available:

1. The current dividend payout ratio is 60 per cent.

2. Dividends are expected to grow at the rate of 5 per cent per year for the foreseeable future.

3. The required return to equity shares in similar companies listed on the Stock Exchange is 9 per cent.

4. The average price/earnings (P/E) ratio for similar businesses listed on the Stock Exchange is 12.6 times.

Required:

(a) Calculate the value of an ordinary share in Mojave plc using the following valuation methods:

(i) net assets (net book value) basis;

(ii) net assets (liquidation) basis;

(iii) dividend growth basis;

(iv) price earnings ratio basis.

(b) State, with reasons, which one of the valuation methods identified in (a) above is likely to provide the most realistic estimate of the market price of an ordinary share in Mojave plc.

Step by Step Answer: