The directors of Tocantins Co. are considering whether to invest in two separate projects: one is small

Question:

The directors of Tocantins Co. are considering whether to invest in two separate projects: one is small while the other is large. They are also trying to decide between two other competing projects. Details of all four projects are set out below.

Project 1

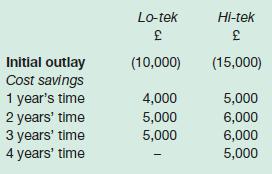

The directors are considering buying a new photocopier, which should lead to cost savings. Two machines that are suitable for the business are on the market. These machines have the following outlays and expected cost savings:

The business will have a continuing need for whichever machine is chosen.

Project 2

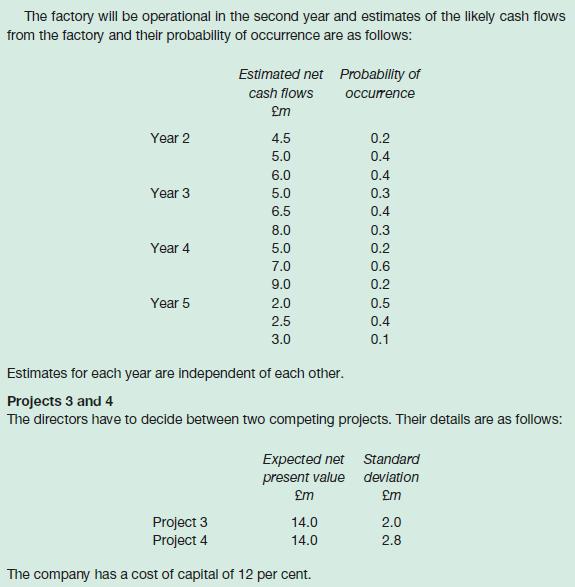

The directors are also considering building a new factory in Qingdao, China to produce clothing for the Western European market. To date, the company has invested £500,000 in researching the proposal and in obtaining the licences necessary to build the factory. The factory will cost £16 million to build and will take one year to complete. Payments for building the factory will be made in 12 monthly instalments during the first year of the investment project.

Required:

Project 1

(a) Evaluate each photocopier using both the shortest-common-period-of-time approach and the equivalent-annual-annuity approach.

(b) Which machine would you recommend and why?

Project 2

(c) Calculate the expected net present value of the project.

(d) Calculate the net present value of the worst possible outcome and the probability of its occurrence.

(e) State, with reasons, whether or not the business should invest in the new factory.

Projects 3 and 4

(f) State, with reasons, which of the two projects should be accepted.

Step by Step Answer: