Thermia Ltd is a family-owned business that produces packaged foods for supermarkets. The family has recently lost

Question:

Thermia Ltd is a family-owned business that produces packaged foods for supermarkets. The family has recently lost interest in the business and has indicated a willingness to sell. The senior managers of the business have decided to make an offer to the family to buy the business and have approached a private equity firm to help raise the finance required. If the purchase offer is accepted, the purchase will take place on 1 December Year 12.

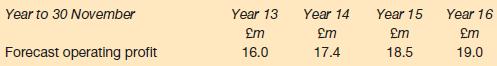

Operating profits for the year to 30 November Year 12 were £15.0m and these are expected to grow steadily over the next four years. The strategic plan for the business shows forecast future profits as follows:

The strategic plan also shows that, to achieve the forecast profits, additional investment in plant and equipment of £8.0m will be required during the year to 30 November Year 15. Depreciation is charged on plant and equipment at the rate of 20 per cent per year on cost for all items held at the year end. Total depreciation charges for non-current assets are currently £4.0m per year. These are included before arriving at the forecast operating profits above. No disposal of non-current assets is planned over the next four years.

The family is prepared to sell all the shares in the business for a multiple of 11 times the current operating profit. To finance the purchase of the shares, the senior managers will provide £10.0m from their own resources and will expect the private equity firm to provide a further £40.0m. A bank will be approached to provide a loan to make up the balance of funds required and this is expected to attract a rate of interest of 8 per cent per year.

All the net cash flows generated by the business will be applied each year to paying off the loan and no dividends or other cash payments to investors will be made until the loan is fully repaid.

The private equity firm will acquire 80 per cent of the shares of the business in exchange for the investment made, which will be realised at the end of four years. At that point, the net assets (excluding the loan) are expected to be sold for 10 times the most recent operating profit. The proceeds from the sale will be used to pay off any remaining loan and the balance will then be distributed to the senior managers and the private equity firm.

The private equity firm has a cost of capital of 25 per cent for this type of investment and uses the internal rate of return to evaluate possible investment opportunities.

Ignore taxation. Workings should be in £ millions and made to one decimal point.

Required:

(a) Calculate:

(i) The loan outstanding as at 30 November Year 16, immediately before the sale of the business

(ii) The approximate internal rate of return that the private equity firm is expected to receive from the investment made.

(b) State, with reasons, whether the private equity firm should undertake the investment.

Step by Step Answer: