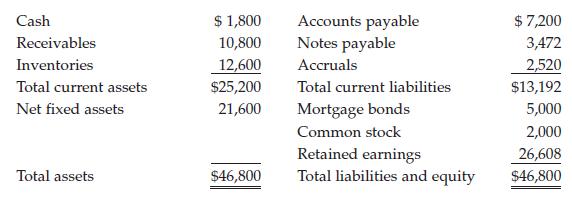

Van Auken Lumbers 2007 financial statements are shown below. Van Auken Lumber: Balance Sheet as of December

Question:

Van Auken Lumber’s 2007 financial statements are shown below. Van Auken Lumber: Balance Sheet as of December 31, 2007 (Thousands of Dollars)

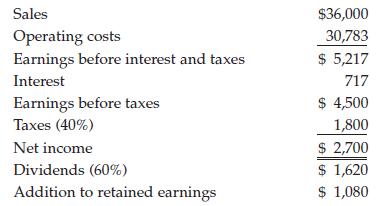

Van Auken Lumber: Income Statement for December 31, 2007 (Thousands of Dollars)

a. Assume that the company was operating at full capacity in 2007 with regard to all items except fixed assets; fixed assets in 2007 were being utilized to only 75% of capacity. By what percentage could 2008 sales increase over 2007 sales without the need for an increase in fixed assets?

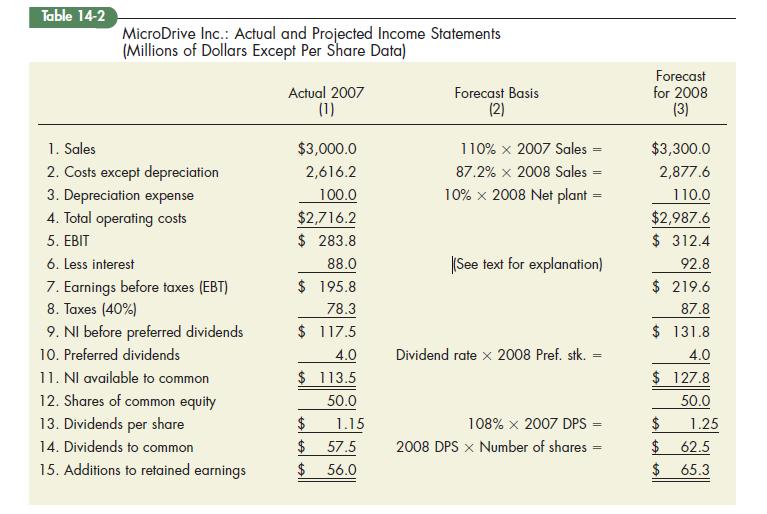

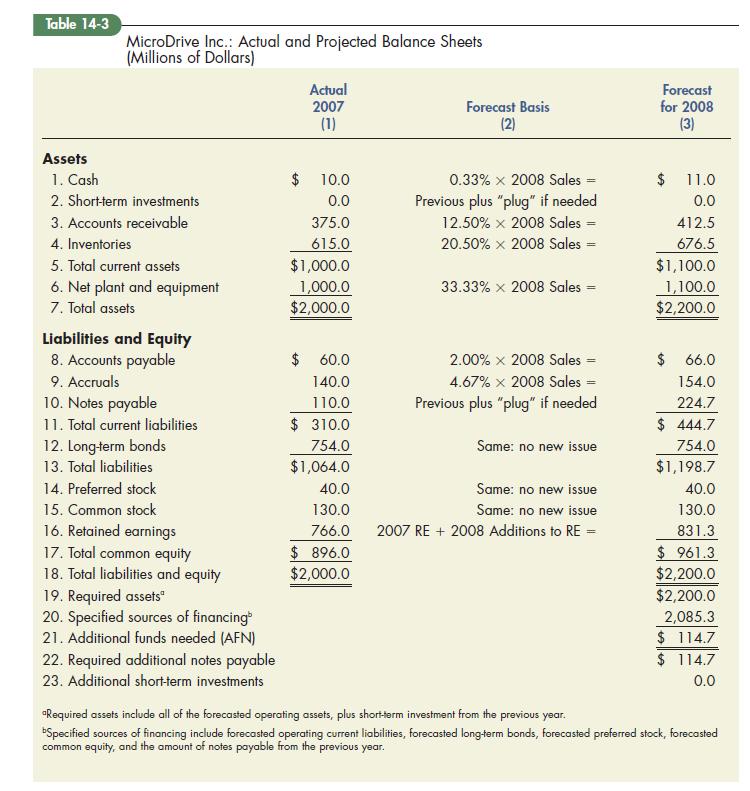

b. Now suppose 2008 sales increase by 25% over 2007 sales. How much additional external capital will be required? Assume that Van Auken cannot sell any fixed assets. (Hint: Use the forecasted financial statements method to develop a pro forma balance sheet and income statement as in Tables 14-2 and 14-3.) Assume that any required financing is borrowed as notes payable. Use a 12% interest rate for all debt at the beginning of the year to forecast interest expense (cash does not earn interest), and use a pro forma income statement to determine the addition to retained earnings. (Another hint: Notes payable = $6,021.)

Step by Step Answer:

Financial Management Theory & Practice

ISBN: 9780324652178

12th Edition

Authors: Eugene BrighamMichael Ehrhardt