Question: 10. (This problem tests your understanding of the chapter appendix.) Sweat Equity Appliance, Inc., a private firm that manufactures home appliances, has hired you to

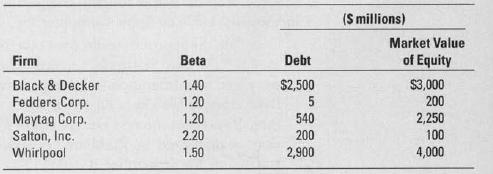

10. (This problem tests your understanding of the chapter appendix.) Sweat Equity Appliance, Inc., a private firm that manufactures home appliances, has hired you to estimate the company's beta. You have ob- tained the following equity betas for publicly traded firms that also manufacture home appliances.

The publicly traded firms all have a marginal tax rate of 40 percent.

a. Estimate an asset beta for Sweat Equity.

b. What concerns, if any, would you have about using the betas of these firms to estimate Sweat Equity's asset beta?

Firm Beta Debt Black & Decker 1.40 $2,500 (S millions) Market Value of Equity $3,000 Fedders Corp. 1.20 5 200 Maytag Corp. 1.20 540 2,250 Salton, Inc. 2.20 200 100 Whirlpool 1.50 2,900 4,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts