Based on the information in Problem 5-6, assume that Booth has just completed a review of its

Question:

Based on the information in Problem 5-6, assume that Booth has just completed a review of its net operating working capital policies and found that it can reduce its DSO to 60 and achieve an inventory turnover of 4.57X without impacting sales or profits, based on a cost of goods sold of $1,600.

a. Recalculate the additional funds Booth requires to achieve its growth target.

b. Assume Booth needed $360 in additional funds for Problem 5-6. Using your answer in part a, how much less will Booth pay in future interest costs, annually, given a 9% interest rate on all additional funds borrowed?

Problem 5-6:

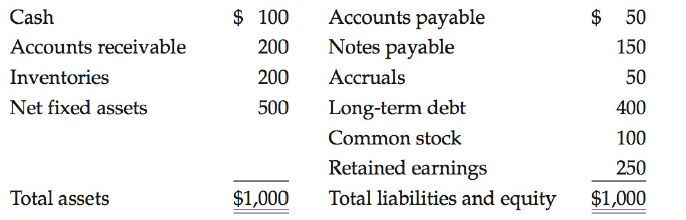

The Booth Company's sales are forecast to increase from $1,000 in 2015 to $2,000 in 2016. Here is the December 31, 2015, balance sheet:

Booth's fixed assets were used to only 50% of capacity during 2015, but its current assets were at their proper levels. All assets except fixed assets increase at the same rate as sales, and fixed assets would also increase at the same rate if the current excess capacity did not exist. Booth's after-tax profit margin is forecasted to be 5%, and its payout ratio will be 60%.

Step by Step Answer:

Financial Management Theory And Practice

ISBN: 978-0176583057

3rd Canadian Edition

Authors: Eugene Brigham, Michael Ehrhardt, Jerome Gessaroli, Richard Nason