Assume that you have recently been hired as Simmons's assistant and that your first major task is

Question:

Assume that you have recently been hired as Simmons's assistant and that your first major task is to help her develop the forecast. She has asked you to begin by answering the following set of questions.

a. Describe three ways that pro forma statements are used in financial planning.

b. Explain the steps in financial forecasting.

c. Assume (1) that OCL was operating at full capacity in 2015 with respect to all assets, (2) that all assets must grow proportionally with sales, (3) that accounts payable and accruals will also grow in proportion to sales, and (4) that the 2015 profit margin and dividend payout will be maintained. Under these conditions, what will the company's financial requirements be for the coming year? Use the AFN equation to answer this question.

d. How would changes in the following items affect the AFN? (1) Sales increase; (2) the dividend payout ratio increases; (3) the profit margin increases; (4) the capital intensity ratio increases; (5) OCL begins paying its suppliers sooner. (Consider each item separately and hold all other things constant.)

e. Briefly explain how to forecast financial statements using the forecast financial statements approach. Be sure to explain how to forecast interest expenses.

f. Now estimate the 2016 financial requirements using the forecast financial statements approach. Assume (1) that each type of asset, as well as payables, accruals, and fixed and variable costs, will be the same percentage of sales in 2016 as in 2015; (2) that the payout ratio is held constant at 40%; (3) that external funds needed are financed 50% by notes payable and 50% by long-term debt (no new common stock will be issued); (4) that all debt carries an interest rate of 10%; and (5) that interest expenses should be based on the balance of debt at the beginning of the year.

g. Why does the forecast financial statements approach produce somewhat different AFN than the equation approach? Which method provides the more accurate forecast?

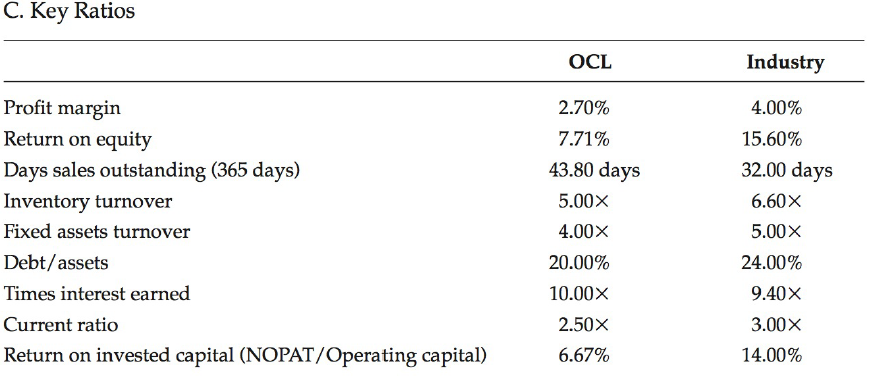

h. Calculate OCL's forecasted ratios, and compare them with the company's 2015 ratios and with the industry averages. Calculate OCL's forecast free cash flow and return on invested capital (ROIC).

i. Based on comparisons between OCL's days sales outstanding (DSO) and inventory turnover ratios with the industry average figures, does it appear that OCL is operating efficiently with respect to its inventory and accounts receivable? Suppose OCL were able to bring these ratios into line with the industry averages and reduce its SGA/Sales ratio to 33%. What effect would this have on its AFN and its financial ratios? What effect would this have on free cash flow and ROIC?

j. Suppose you now learn that OCL's 2015 receivables and inventories were in line with required levels, given the firm's credit and inventory policies, but that excess capacity existed with regard to fixed assets. Specifically, fixed assets were operated at only 75%

of capacity.

(1) What level of sales could have existed in 2015 with the available fixed assets?

(2) How would the existence of excess capacity in fixed assets affect the additional funds needed during 2016?

k. The relationship between sales and the various types of assets is important in financial forecasting. The forecasted financial statements approach, under the assumption that each asset item grows at the same rate as sales, leads to an AFN forecast that is reasonably close to the forecast using the AFN equation. Explain how each of the following factors would affect the accuracy of financial forecasts based on the AFN equation: (1) economies of scale in the use of assets and (2) lumpy assets.

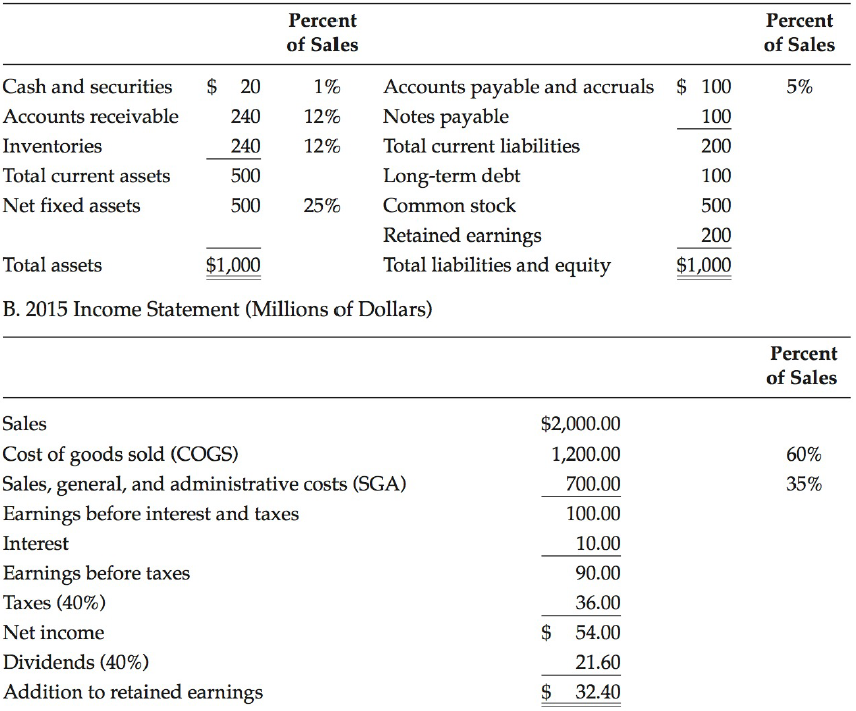

Betty Simmons, the new financial manager of Okanagan Chemicals Ltd. (OCL), a B.C. producer of specialized chemicals for use in fruit orchards, must prepare a financial forecast for 2016. OCL's 2015 sales were $2 billion, and the marketing department is forecasting a 25% increase for 2016. Simmons thinks the company was operating at full capacity in 2015, but she is not sure about this. The 2015 financial statements, plus some other data, are shown below.

A. 2015 Balance Sheet (Millions of Dollars)

Inventory Turnover RatioThe inventory turnover ratio is a ratio of cost of goods sold to its average inventory. It is measured in times with respect to the cost of goods sold in a year normally. Inventory Turnover Ratio FormulaWhere,... Financial Statements

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial... Balance Sheet

Balance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial... Free Cash Flow

Free cash flow (FCF) represents the cash a company generates after accounting for cash outflows to support operations and maintain its capital assets. Unlike earnings or net income, free cash flow is a measure of profitability that excludes the...

Step by Step Answer:

Financial Management Theory And Practice

ISBN: 978-0176583057

3rd Canadian Edition

Authors: Eugene Brigham, Michael Ehrhardt, Jerome Gessaroli, Richard Nason